Panic in SAP Shares – Fastest Decline Since 2022

SAP (SAP.DE) published its fourth quarter results, which disappointed investors mainly due to weaker growth in its current cloud backlog, causing a sharp drop in its share price. Despite some positive elements, such as growth in cloud revenue and profitability, the market reacted negatively due to concerns about slowing growth and AI competition. Shares are currently trading nearly 14% lower than yesterday’s close and at their lowest levels since May 2024.

*Non-IFRS is a measure of profitability that adjusts for one-off costs (e.g., restructuring, write-offs), providing a clearer picture of current operations.

Key Q4 results

- Non-IFRS revenue: €9.68 billion (expected €9.74 billion)

- Non-IFRS cloud revenue (year-over-year growth in constant currencies): +26% (expected +25.8%)

- Current cloud backlog (year-over-year growth in constant currencies): +25% (expected +24.8%)

- Non-IFRS operating profit: €2.83 billion (expected €2.79 billion)

- EPS Non-IFRS: €1.62 (expected €1.52)

- Free cash flow: €1.03 billion (expected €988.1 million)

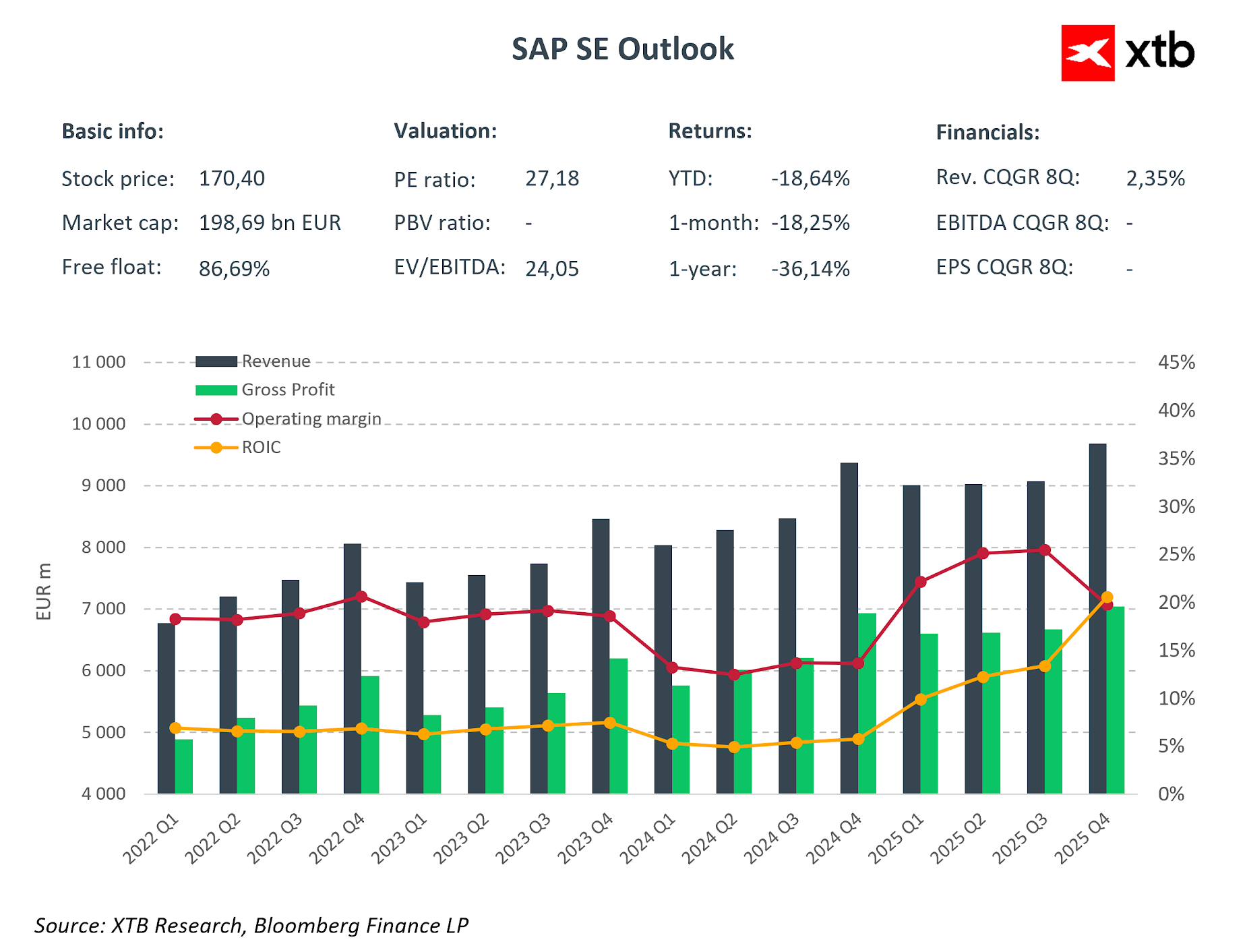

Key company data and historical overview. Valuation indicators. Source: XTB

Forecasts for 2026

- Non-IFRS cloud revenue: €25.8-26.2 billion (consensus €25.96 billion)

- Non-IFRS operating profit: €11.9-12.3 billion (consensus €12.02 billion)

- Free cash flow: approx. €10 billion (consensus €9.48 billion)

- The growth of the current cloud backlog is expected to slow down slightly from Q4 levels.

Market reaction

SAP shares fell as much as 11% during the day—the biggest intraday decline in more than five years—after a disappointing backlog.

Analysts’ opinions

- JPMorgan: Negative reaction to slowdown in backlog, but FCF above expectations.

- Goldman Sachs: Strong cloud revenue growth of +26%; expects moderate cuts to revenue forecasts.

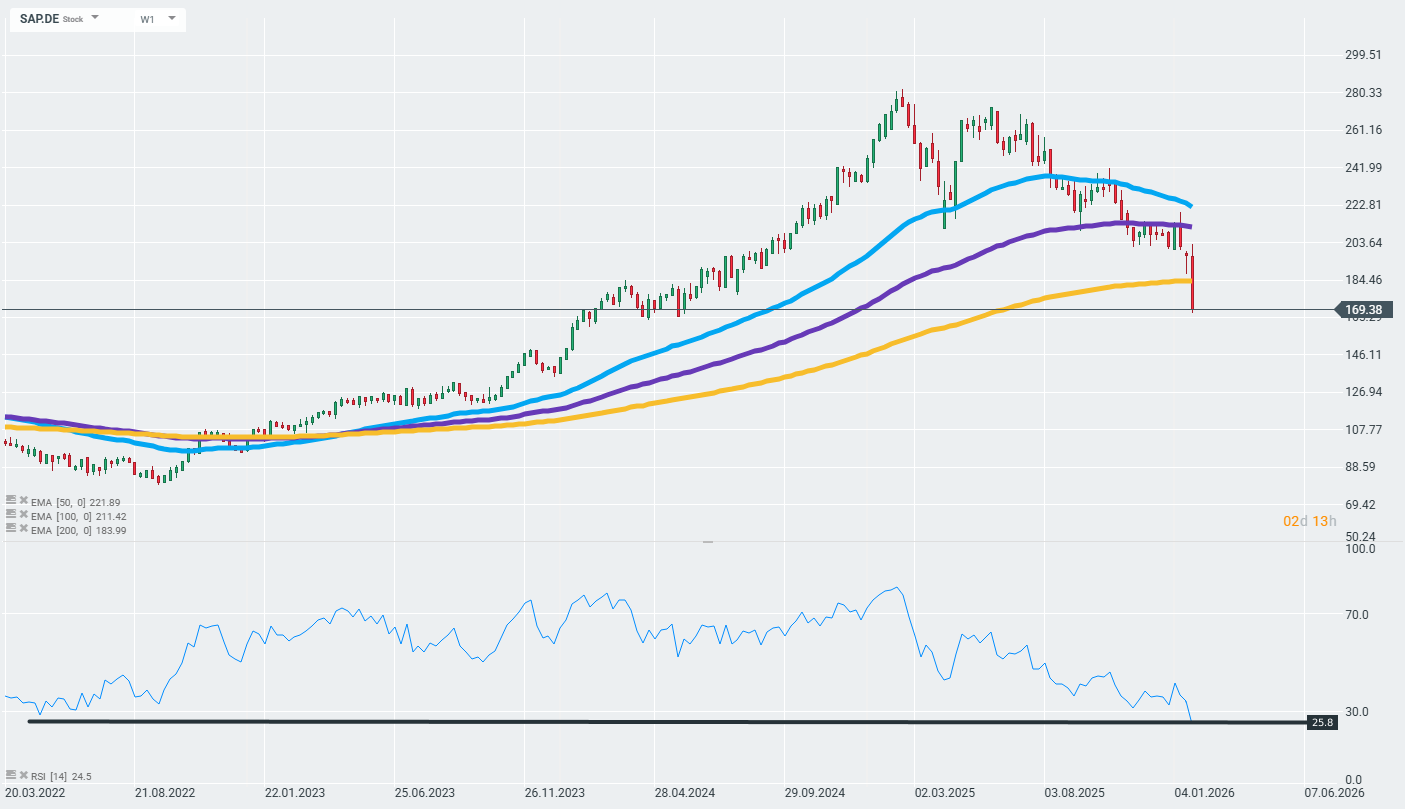

The company’s shares fell below the 200-week EMA today for the first time since 2022. The RSI for the last 14 weeks is at levels not seen since 2002. Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.