Strong PMI Data From Germany While Franc Sees Mixed Data

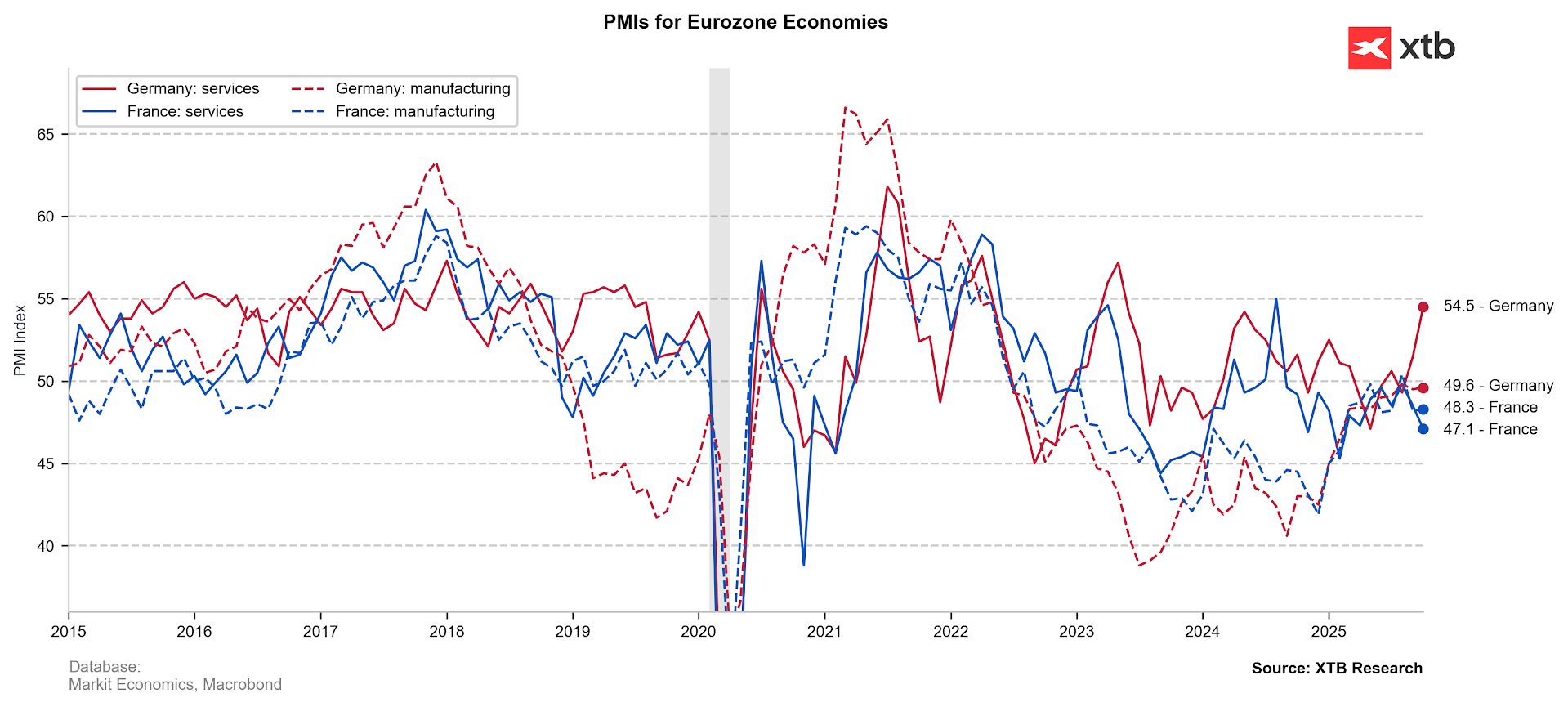

Germany Manufacturing PMI (preliminary, October): 49.6 (expected: 49.5; previous: 49.5)

Germany Services PMI:54.5 (expected: 51.0; previous: 51.5)

France Manufacturing PMI (preliminary, October): 48.3 (expected: 48.2; previous: 48.2)

France Services PMI:47.1 (expected: 48.7; previous: 48.5)

Germany PMI: Clear improvement, but risks remain

Germany’s PMI data show the fastest growth in output in over two years, with rising new orders and backlogs in both manufacturing and services. This suggests a strong start to Q4 and a pickup in economic recovery. Particularly positive is the increase in orders and employment in services, although manufacturing continues to see job cuts. Supply-chain uncertainties (notably in semiconductors) persist, negatively impacting sectors such as automotive. Rising labor costs continue to feed through to higher prices, but service firms are managing to pass part of these costs on to clients.

France PMI: Further decline, moderate labor optimism

France’s PMI indicators were weak, with the October Flash Composite PMI falling to 46.8 points, firmly in recession territory. The decline in output across both manufacturing and services points to broad-based demand weakness. Companies remain cautious about the outlook, reflecting a fragile global environment and domestic political uncertainty. On a positive note, labor market resilience and easing price pressures may offer some relief for the ECB. Despite efforts to stimulate sales through price cuts, the French economy continues to face a prolonged period of stagnation.

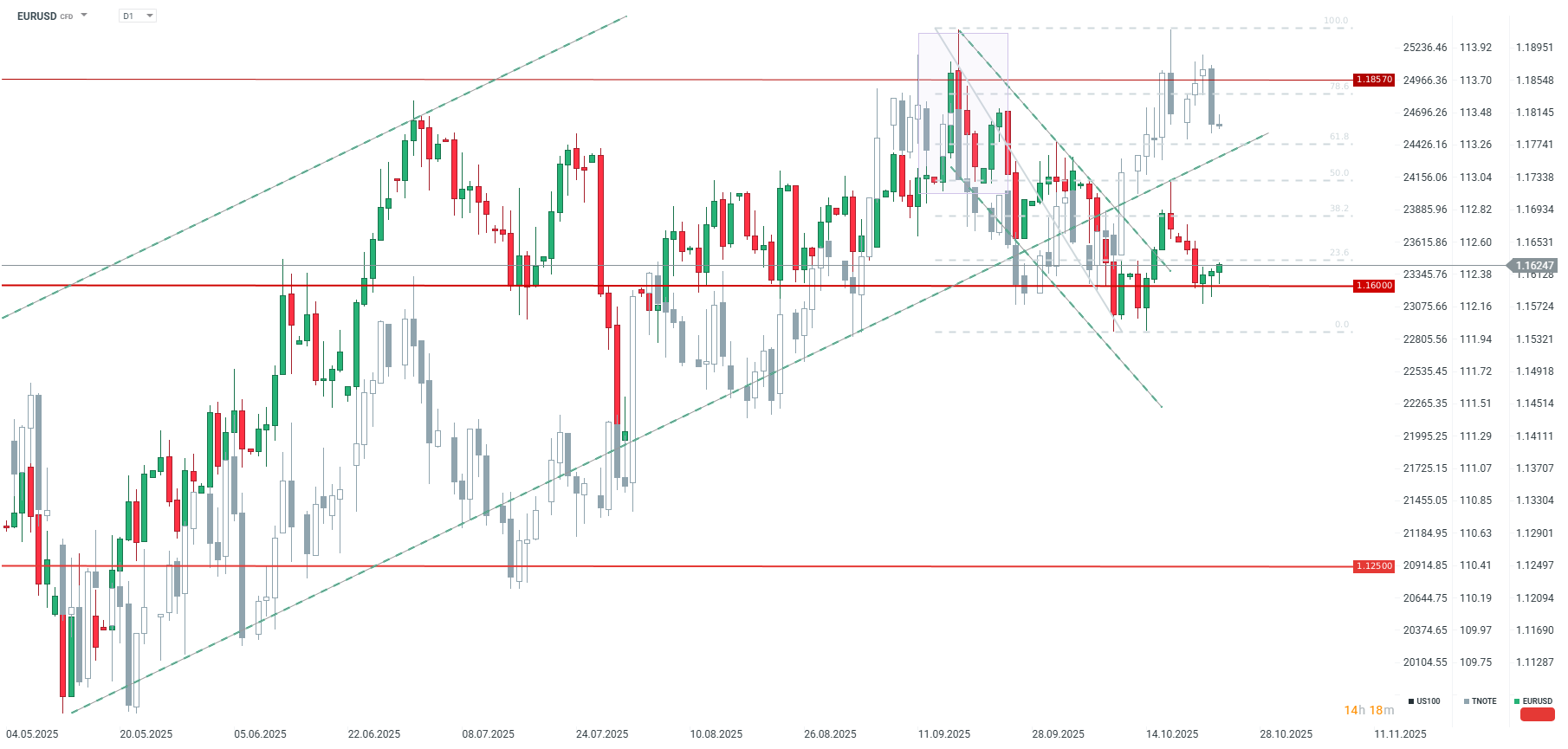

EURUSD continues moderate gains

Looking at the EURUSD pair, we observe a clear upward attempt over the last three sessions, with buying interest around the 1.1600 level. The U.S. dollar remains uncertain ahead of the Fed’s decision and amid ongoing government shutdown concerns. Although U.S. yields have climbed back above 4%, the EURUSD still shows a significant divergence from TNOTE, suggesting the U.S. dollar may be overvalued.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.