Technicals – DAX40

The European session is proceeding in a calm mood, with a predominance of moderate optimism. Most indices remain around the opening levels, but with slight increases. The growth leader is FTSE1000, whose contracts are rising by over 1.4% on the wave of new expectations regarding the interest rate path. ITA40 and NED25 contracts are up by 0.4%. DAX remains around the opening price of the quotations. Declines can be observed in French and Swiss indices, but they are limited to 0.3%.

Investors on the European market have a long series of political information and macroeconomic data to discount.

- Donald Trump threatens retaliation against European technology companies in response to fines against American corporations. The US president also threatens invasion of Venezuela again. This may generate additional volatility during the session or in the coming days.

- Germany is introducing a series of significant decisions that the market may interpret as growth-oriented. Firstly, the EU coalition voted for significant concessions in the law banning the sale of combustion vehicles. At the same time, Germany is withdrawing from a series of restrictions on electricity consumption by enterprises.

- KNDS — The German tank manufacturer is preparing IPO plans, and the company’s management is expected to present a preliminary schedule for entering the public market by the end of this week.

Macroeconomic data:

- Inflation in the UK: The CPI reading turned out to be below expectations, reaching 3.2% year-on-year compared to the expected 3.4%. On a monthly basis, deflation was recorded at 0.2%. This provides more room for rate cuts by the BoE.

- The IFO index from Germany is below expectations, remaining in contraction territory at 87.6.

- Eurozone HCPI inflation was in line with market expectations, at 2.4% annually and -0.5% MoM.

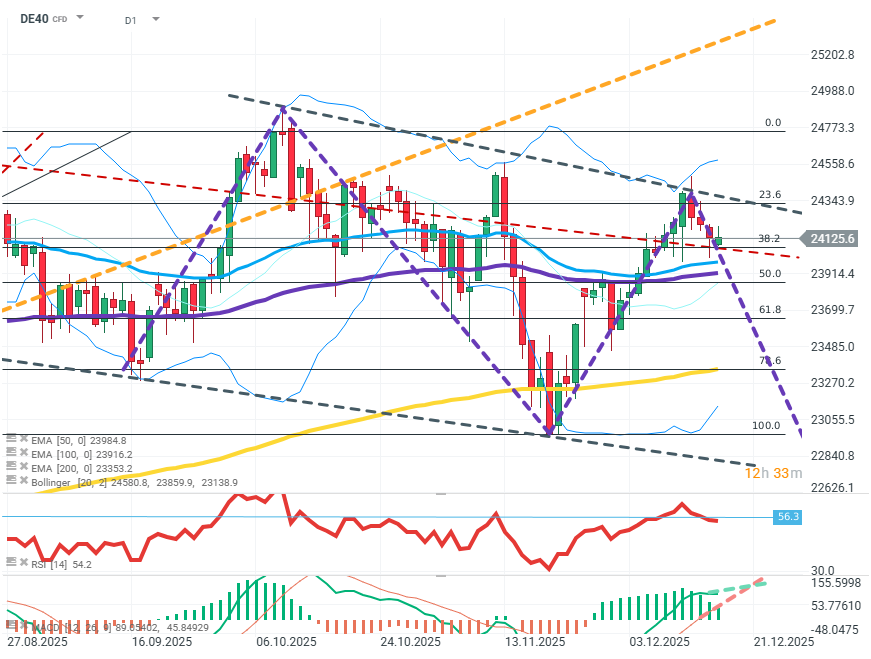

DE40 (D1)

Source: xStation5

The chart shows the continuation of the formation of a broad downward pattern with a low trend slope. The EMA average and MACD show a decreasing spread, indicating growing weakness among buyers, who need to break the FIBO 23.6 level to prevent further declines. If sellers want to maintain the initiative, it is crucial to quickly overcome the EMA 50 and 100 averages and then FIBO 50.

Company news:

- RENK (R3NK.DE), Rheinmetall (RHM.DE) – German defense companies are correcting part of the recent declines. This is a result of further failures in peace negotiations, NATO countries’ purchases, and information about alleged, unannounced Russian military gatherings and exercises in Belarus. Valuations are rising by about 1.5-2.5%.

- Siemens Healthineers (SHL.DE) – The company announces that one of its owned startups is reporting progress in ongoing projects.

- Suedzucker (SZU.DE) – The food producer published a disappointing revenue growth forecast. The company is losing over 3%.

- Thyssenkrupp Nucera (NCH2.DE) – The company specializing in energy equipment published results above expectations and with good forecasts for the future. Shares are up by over 2%.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.