The DAX Loses Ground But Maintains 50-Day EMA

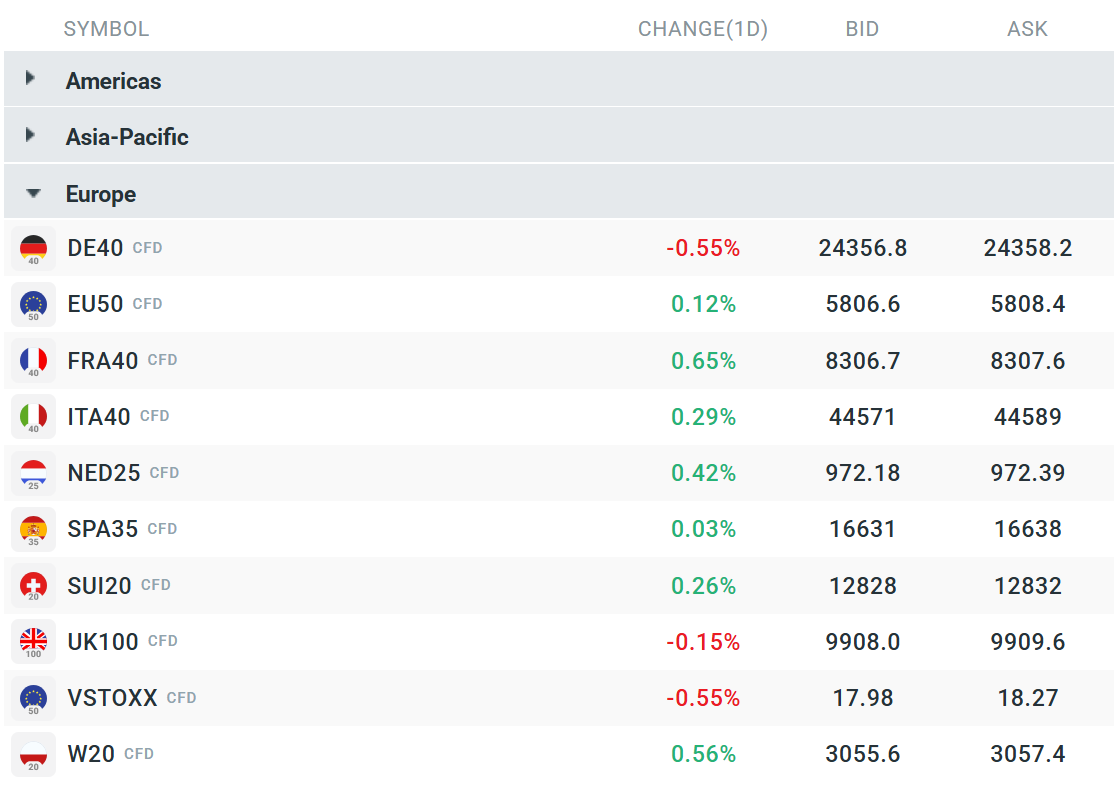

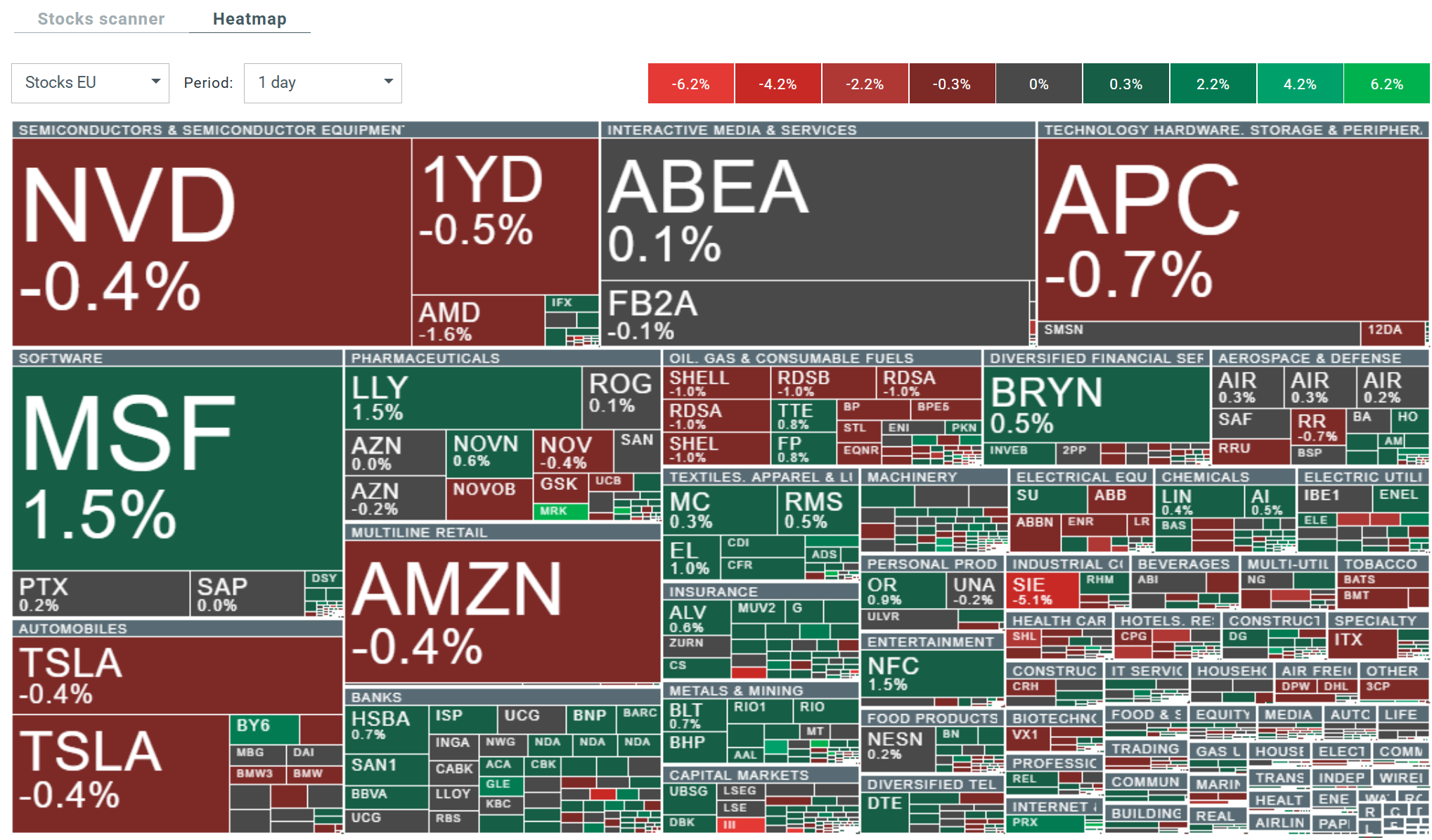

European indices are posting mixed results during the first phase of Thursday’s session – the STOXX 600 is up just 0.06%, the DAX is down 0.43% and the FTSE 100 is down 0.42%, suggesting caution among investors amid macroeconomic uncertainty. At the same time, the Polish stock market (WIG20 +0.69%) is rising amid European weakness. Interestingly, the index of the largest companies temporarily broke through to new local highs today.

Investors are focusing today on companies’ quarterly results. Below you will find comments on Siemens, Deutsche Telekom and Burberry.

Source: xStation

Current volatility observed on the broader European market. Source: xStation

During Thursday’s session, the DAX remained above the 50-day exponential moving average (blue curve on the chart), which, after breaking through this week, once again became an important barrier indicating a short-term upward trend for the instrument. Until the DE40 breaks below this zone and other 100- and 200-day EMAs, the current trend is likely to continue. Source: xStation

Company results published today:

Siemens – Record results in fiscal year 2025

Siemens (SIE.DE) ended fiscal year 2025 with solid results, achieving revenues of €21.43 billion, which was in line with market expectations. Orders rose to €21.94 billion, exceeding consensus estimates, suggesting solid demand for the company’s products and services. Net profit of €3.09 billion significantly exceeded expectations (€1.93 billion), demonstrating the company’s ability to convert revenue into profits. The gross profit margin was 15.3%, slightly below forecasts (15.7%), but remained at a level indicating operational stability. Net cash flow was €5.3 billion in the fourth quarter, reflecting the company’s ability to convert profits into cash. Looking ahead, Siemens forecasts comparable revenue growth of 6-8% in 2026 and earnings per share of €10.40-€11.00, indicating moderate but stable growth.

Deutsche Telekom – Solid results for the third quarter

Deutsche Telekom (DTE.DE) reported revenues of €28.94 billion in the third quarter, broadly in line with market expectations. Adjusted EBITDA AL came in at €11.12 billion, slightly below forecasts, but organic growth of 2.9% showed consistent progress despite macroeconomic challenges. Cash flow (post-lease FCF) was €5.6 billion for the quarter, with a full-year projection of €20.1 billion, suggesting solid cash generation. The dividend per share increased to €1.00, up from €0.90 a year earlier, reflecting the company’s commitment to returning value to shareholders. The company also announced a share buyback plan of up to €2 billion in 2026, which could support the share price. Organic revenue growth of 3.3% in the third quarter shows that Deutsche Telekom is maintaining its growth momentum despite the competitive environment in the telecommunications market.

Burberry – Challenging market conditions and strategic transformation

Burberry (BRBY.UK) faced significant challenges in the first half of fiscal year 2025, with revenues falling by approximately 3% (ex-FX), below expectations. Comparable retail sales rose 2% in the second quarter, slightly above forecasts (0.62%), but this positive trend does not offset the overall downward trend for the half-year as a whole. The company is maintaining its capital plans at around £120 million, down from £130 million last year, indicating a more conservative approach to investment. The turnaround strategy, dubbed “Burberry Forward”, is showing early signs of success, particularly in the outerwear segment and the new Autumn 2025 collection. A strong focus on rebuilding the brand’s luxury status/level through heritage-inspired products and a change in wholesale strategy give hope for improved results in the second half of the year. Macroeconomic uncertainty and weakness in the Chinese market remain the main risks, but growing interest in wholesale distribution and initial sales results suggest that the transformation may yield results in the medium term.

What does the sell side say?

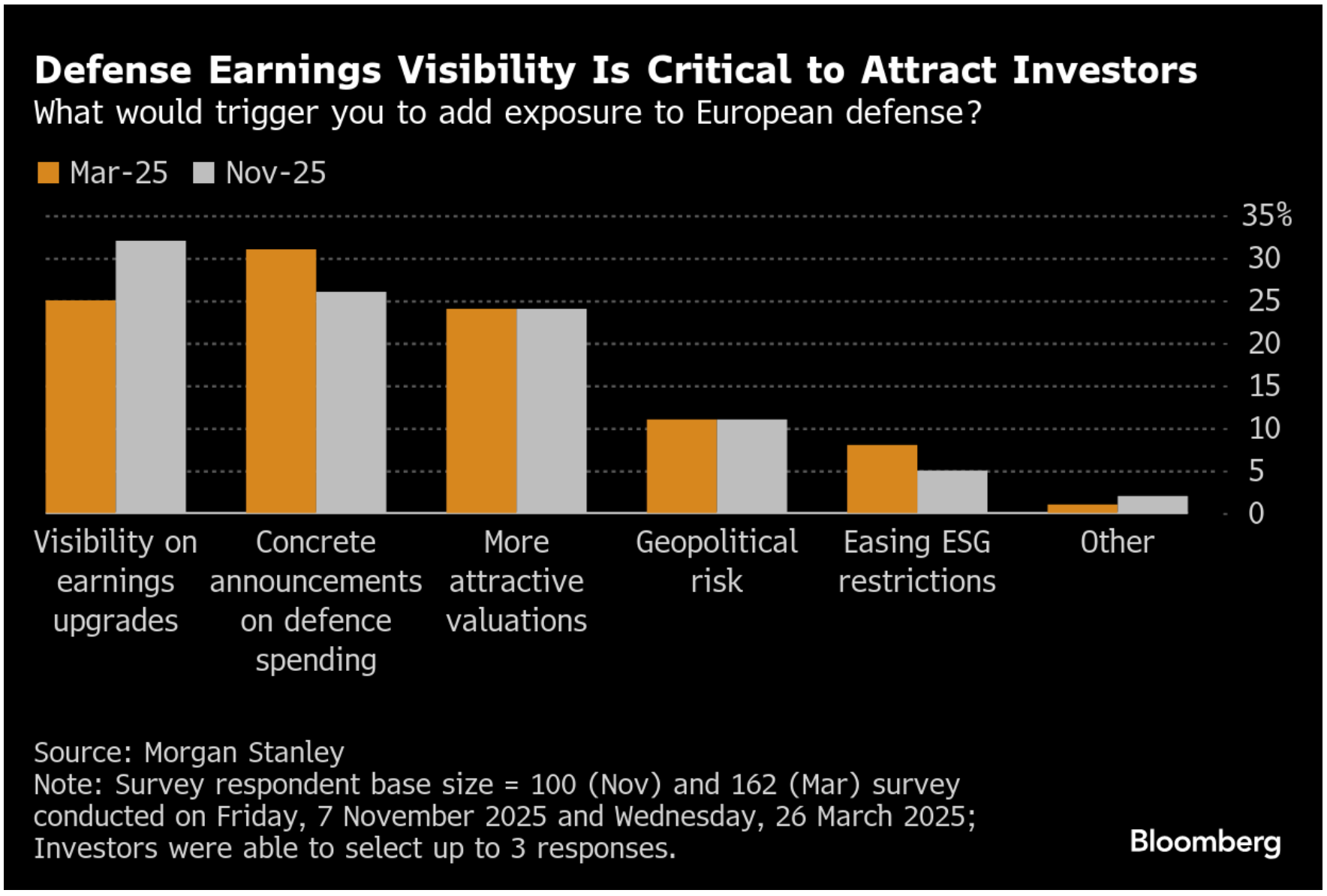

European defence stocks have risen 80% this year, but have been consolidating since June due to high valuations (70% premium to the European market) and weak financial results. Investors who previously bought every dip are now waiting for government defence spending promises to translate into actual company results.

The sector’s latest financial results have been disappointing. Rheinmetall maintained its guidance, which brought relief, but shares have been flat since June. Hensoldt has fallen 25% from its October peak after disappointing new guidance and a downgrade to neutral by JPMorgan. Rolls-Royce, whose shares have doubled in value this year, fell after it did not extend its share buyback programme. Renk has fallen 25% since the beginning of October, despite having previously risen almost fivefold.

UBS analysts point out that the sector is over-positioned and overvalued relative to variable, rather than fixed, income growth, to return to the rapid growth we have seen in the past. Source: Bloomberg Financial Lp

A Morgan Stanley survey of more than 100 investors shows that investors now need better insight into the outlook for revenue growth, new orders and specific defence spending plans in order to add exposure to the sector. Source: Bloomberg Financial Lp

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.