The Week Ahead – Yen intervention dominates as gold tops $5,000

The Week Ahead: yen intervention dominates as gold tops $5,000

The FX market is front and centre at the start of this week and the focus is on the huge move higher in the yen. USD/JPY crumbled on Friday and there has been an extension to this move at the start of this week. After reaching a high above 159.00, USD/JPY is now approaching 154.00. Reports suggest that Japanese officials were joined by the Federal Reserve Bank of New York who bought yen to support the beleaguered currency, according to Bloomberg.

US steps in to prop up the yen

This has not been confirmed by the Fed, however, there are reports that the Fed has been in touch with US banks asking about yen rates, which is usually a precursor to intervention. This is an unusual move, in the past multilateral FX market intervention has only happened during extraordinary events, such as after the Japanese tsunami in 2011.

Japan yen intervention to support weak bond market

When the Fed steps in, you know it is serious. Last week, the yen tanked while Japanese bond yields soared, leading to fears about a fiscal crisis in Japan, where the debt to GDP ratio is 250%. This was a sign of a broken market that could have ramifications for global finance, given the importance of Japanese investors to global capital flows.

Will intervention work?

The immediate signs are that intervention from Japan, and now the US is working, However, authorities cannot intervene forever. The reasons why the yen is falling and Japanese yields are rising include a massive debt load and a PM who called an election and is running on a fiscal expansion ticket, have not changed. So, there are real concerns that this won’t work. This means that volatility in the FX market could be here to stay.

A stronger yen = a weaker dollar

In the short term, a stronger yen means a weaker dollar, which is inflationary for the US. This is a good way to inflate away some of the US’s debt pile, however, it may cause a big headache for the Federal Reserve. The central bank will meet this week, and we expect yen intervention to be a major topic up for discussion, along with the future of Fed independence.

However, coordinated action is also a sign that the US authorities are actively willing to devalue the dollar. This is leading to dollar debasement fears, and is one reason why the gold price reached fresh record highs this morning, the yellow metal is now trading above $5,000 per ounce. The silver price is higher by more than 4% at the start of this week, as demand for precious metals continues to grow as we move through 2026.

Equities set to sell off, as risk sentiment remains fragile

Volatility in the FX space is feeding into a bumpy start for risky assets this morning. Equities in Japan fell 1.7% today, and European and US equity futures are pointing to a lower open later today. The fact that the Federal Reserve has been forced to step in to support the yen is leading to fears that Japan is a major problem for the global economy.

Bitcoin also slumped on Sunday as risky assets sold off, it fell to its lowest level of this year. While crypto has underperformed the broader market in recent months, there is a whiff of risk aversion at the start of the new week. If we see a deeper sell off in Bitcoin, then it may be a sign that equities could struggle at the start of this week.

Back-to-back losses for the S&P 500

Recent stock market action is worth analyzing. Stocks in the US and across Asia recorded losses for last week, the first back-to-back week of losses for the S&P 500 since June last year. The coming days for equity markets will be crucial as there is a huge amount for investors to digest: an upcoming Fed meeting, tech earnings season and a populist US president who has unorthodox economic and foreign policies.

Europe underperforms, weighed down by defense

US stocks outperformed European indices last week, as defense stocks in Europe fell after Donald Trump backed away from threats to take Greenland by force. A strong rally for car makers and European tech stocks on the back of Trump also dropping his tariff threat for Europe and the UK could not help the index eke out a gain last week.

Divergence in tech stock performance

The MSCI World index excluding the US outperformed the S&P 500, and US small and mid-caps also managed to post a narrower loss than the blue chip US indices. The Philadelphia semiconductor index posted a 1.5% gain last week, which suggests that tech is not moving as a unified block anymore. There were strong gains for Microsoft, Nvidia, Palantir and AMD. However, Intel fell 17% on Friday after reporting weaker than expected earnings guidance for this quarter. Sandisk, the memory chip maker which surged at the start of this year, also fell 5.8%

Are the Magnificent 7 cheap?

The contrasting fortunes of the Magnificent 7, which are making a comeback, and the new kid on the block Sandisk could come down to valuation. Sandisk has rallied nearly 100% so far in January and has a P/E ratio of 677 times last year’s earnings. This is huge and suggests that Sandisk is extremely expensive. In contrast, the Magnificent 7 have seen their valuations fall to their lowest level in months, which may be enticing investors to go long once more.

Commodity market confirms status as top performer in 2026

While stocks remain volatile, commodities are firmly in an uptrend this year. There were gains across the energy markets, along with strong gains for gold and silver last week. The price of nat gas rose by an astonishing 68% last week alone, as harsh winter storms across the US pushed up demand for energy. US storms have grounded the largest number of flights in the US since Covid. The storm is affecting half of the population of the US and covers 32 states; on top of this, 236,000 people and businesses are without power. The effects of the storm could last for days, however, if the weather picks up, then the Natgas rally could rapidly unravel. For now, the ferocity of the bad weather in the US, and the threat that it poses to energy and electric infrastructure is keeping the gas price well supported, and nat gas rose another 5% on Friday.

Trump throws tariff threat at Canada

The main news from the White House over the weekend centred on Trump’s threat to impose a 100% tariff rate on Canada if it secures a trade deal with China. Trump argued that Canada would be used to funnel cheap Chinese goods into the US. Canada responded by saying that it was not pursuing a free trade deal with China, which is one of the reasons why the market reaction so far has been mild. The broad sell-off in the dollar at the start of this week is boosting the CAD.

Is gold the ultimate anti-Trump trade?

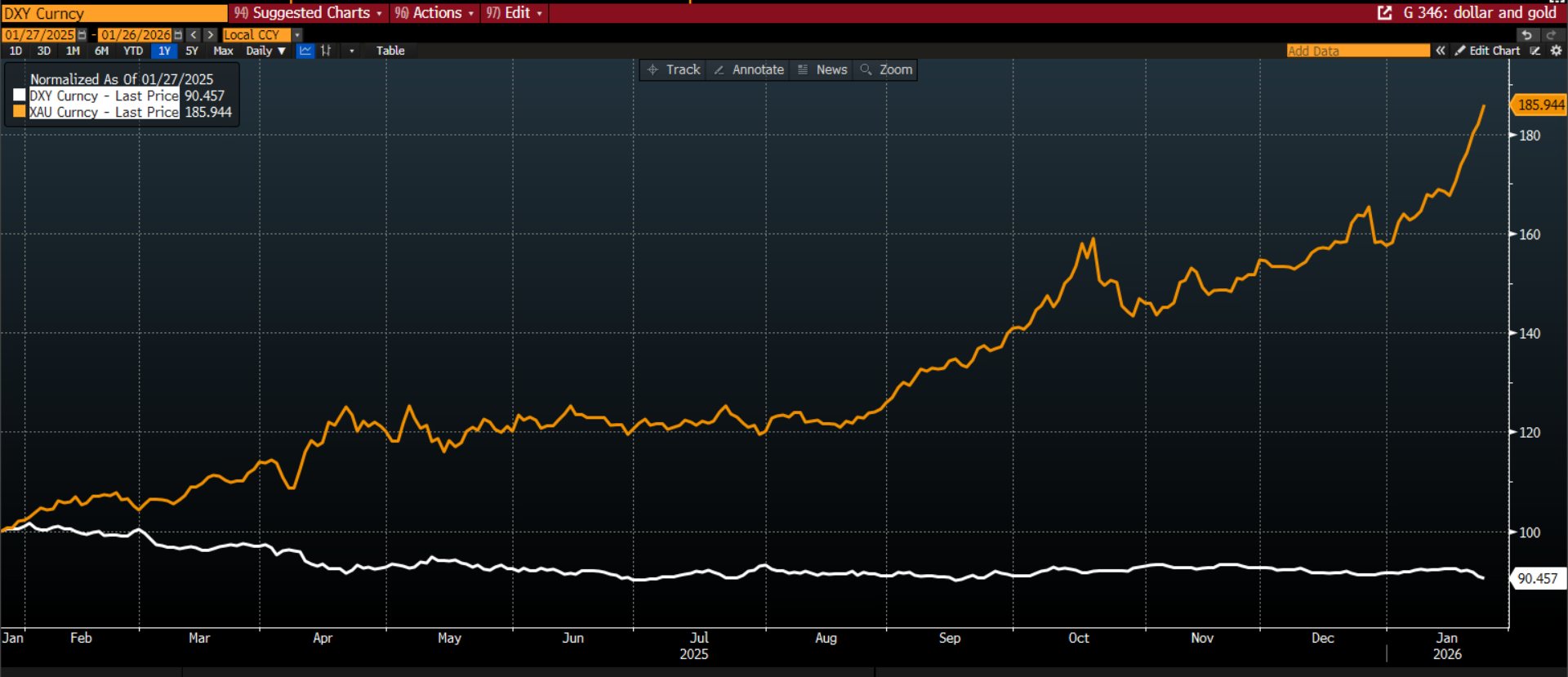

There are multiple reasons why the dollar is fading this week, including FX intervention to prop up the yen, however, in a world where people are questioning the US administration’s foreign and domestic policies, is there any wonder why the dollar is faltering and gold is rising? The dollar is the weakest currency in the G10 FX space so far this year. At the same time. The gold price has rallied more than 17%, and is now above $5,000 per ounce. If the US’s radical policy positions are feeding demand for gold, then the yellow metal could become the ultimate anti-Trump trade and there could be further upside to come.

Chart 1: Gold and the Dollar index, normalized to show how they move together over the last 12 months.

Source: XTB and Bloomberg

Silencing of Andy Burnham could see Gilt market recover

Interestingly, the pound managed to post a solid gain vs. the USD last week and GBP/USD rose by 1.6%, even though the Gilt market had a bit of a wobble. The 10-year Gilt underperformed US and European peers last week, and the yield rose nearly 10bps, after rumours began circulating that Andy Burnham, the current mayor of Manchester, would stand for election as an MP giving him a clear path to challenge Kier Starmer as prime minister.

After a strong run in 2025, it looks like political risks could threaten the UK bond market this year. Andy Burnham famously said that if he were PM, he would not be in hock to the bond market. However, bond investors need not worry, and we could see Gilts stage a mini recovery on Monday, as it turns out the Labour Party itself will not allow Burnham to stand and give up his position as mayor. Party officials argued that the cost of running new mayoral elections cannot be justified, which keeps the wolves at bay from Kier Starmer for now.

It is likely to be an uncomfortable few weeks for the PM as he faces criticism for not letting Burnham stand as an MP. However, from a market perspective, the threat of an even more left-leaning PM who may have supported an increase to UK borrowing to unsustainable levels has evaporated, and this is why Gilts may recover as the political risk premium is reduced.

The pound’s strength stems from a better-than-expected PMI reading for January. UK businesses saw their strongest uplift in activity since April 202, with signs of strength in domestic and foreign markets.

This is a big week for both economic data, central bank meetings and earnings season. Below we look at two of the main events not to miss.

1, FOMC decision preview

The first FOMC meeting of the year takes place on Wednesday and we are expecting any change to interest rates, which are expected to remain at 3.5-3.75%. This comes after Donald Trump subpoenaed the Fed chair, Jerome Powell, earlier this month. Powell then criticized the decision and launched an extraordinary attack on the President, accusing him of threatening Fed independence.

The Fed is standing firm: policy will be based on incoming economic data and not the President’s whims, and we expect the majority of the FOMC board to say that the data is too strong to support a rate cut right now. There is only a 2% chance of a cut at this week’s meeting, and the first rate cut from the Fed is now not expected until June. The pickup in US labour market data has led to a recalibration of US rate cut expectations. There are now less than 2 rate cuts priced over the next 12 months, and over the last 3 weeks, the market has pushed up year-end interest rate expectations for the US from 3.03% to 3.18%. If President Trump is looking to lower interest rates, the market is moving in the opposite direction.

Overall, this meeting could support the dollar, which is in freefall at the start of this week. The dollar index has gapped below 97.0, and is less than 80 points away from the lows of the last 12 months.

2, Tech earnings season

As mentioned, traders have focused on the smaller, niche tech stocks so far in 2026. However, this week we some of the mega-cap tech stocks will report their results. This will ultimately tell us if that trading strategy is the right one.

The companies who are scheduled to report results include Meta, Microsoft and Tesla on Wednesday night, after the FOMC meeting. Apple will also report results on Thursday. The big tech earnings will reveal whether costly AI investments are paying off. If 2025 was the year of capex spending, then 2026 is the year of seeing how that money has paid off.

The magnificent 7’s stock price momentum has slowed dramatically since that start of Q4. If these stocks are to pick up, then traders will want clear proof that AI investments are paying off. Cloud computing and AI growth is expected to remain impressive for last quarter; however the bar is high, and one slip-up on forward guidance or ROI for AI spend could lead to a sell-off.

The Magnificent 7 are at the cheapest they have been for months, this week’s earnings report will determine if they are a bargain.

Chart 2: Microsoft and Meta P/E valuations vs. the S&P 500 average P/E valuation

Source: XTB and Bloomberg

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.