Trade of The Day – GOLD.XAU/USD

Facts:

- Goldman Sachs, RBC, and Deutsche Bank all forecast gains in the gold market in 2026.

- Gold has defended the 4,000 USD/oz level and is currently trading around 4,200 USD/oz.

Recommendation:

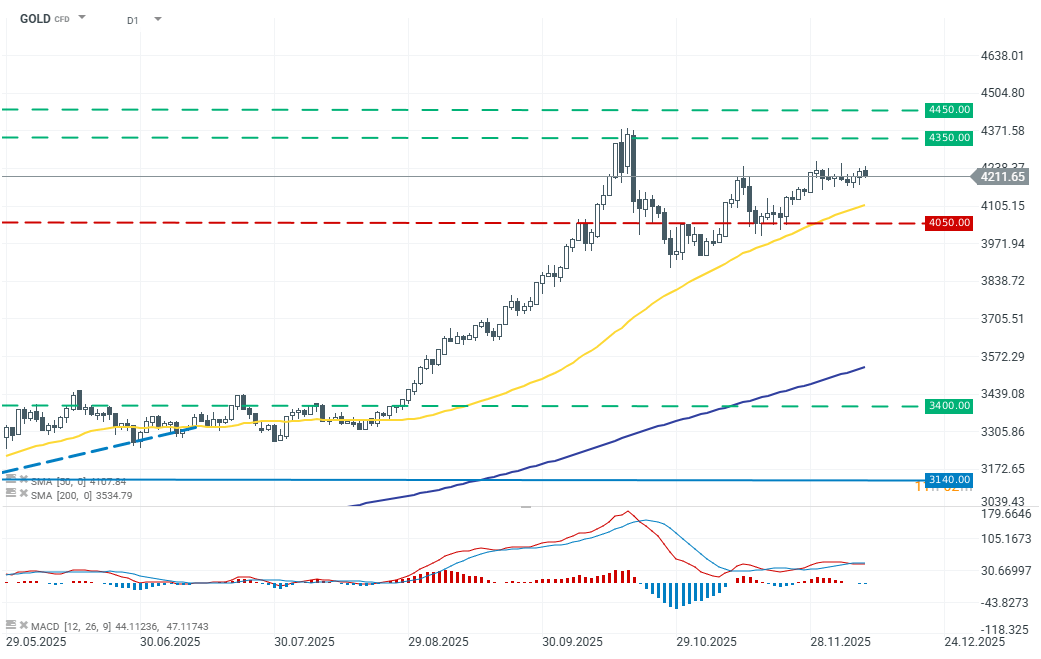

Long position at market price

- TP1: 4,350

TP2: 4,450

SL: 4,050

Opinion:

Gold continues to be in a structural, multi-year bull market, driven by exceptionally strong central-bank demand, a weak dollar, and expectations of Fed policy easing in 2026. Forecasts from major institutions point to further gains: RBC sees an average price of 4,600 USD in 2026 and 5,100 USD in 2027; Deutsche Bank has raised its 2026 target to 4,450 USD; and Goldman Sachs expects up to 4,900 USD (approx. +20% from current levels). Gold is currently trading above 4,200 USD/oz — around 8% above the local bottom and only about 5% below the all-time high near 4,400 USD. Structural demand remains strong: central banks are buying over 1,000 tonnes per year, roughly 2× the decade average, and Goldman estimates future purchases at about 80 tonnes per month.

The supply–demand balance remains favorable, as portfolio investors and central banks are “absorbing” most of the available supply, leaving relatively little metal for the jewelry market — creating a “positive market structure.” Geopolitical conditions are also not improving, and capital continues to flow into the safe haven of gold. Taking these factors into account, along with technical analysis, we recommend opening a long position in gold at the market price. At the same time, we advise placing a stop-loss order to minimize the risk of potential loss.