Trade of The Day – USD/IDX

Facts:

- Donald Trump announced on social media that an agreement has been reached on Greenland and, more broadly, the Arctic within the NATO framework.

- The US dollar has fallen by more than 1.10% on a weekly basis.

Recommendation:

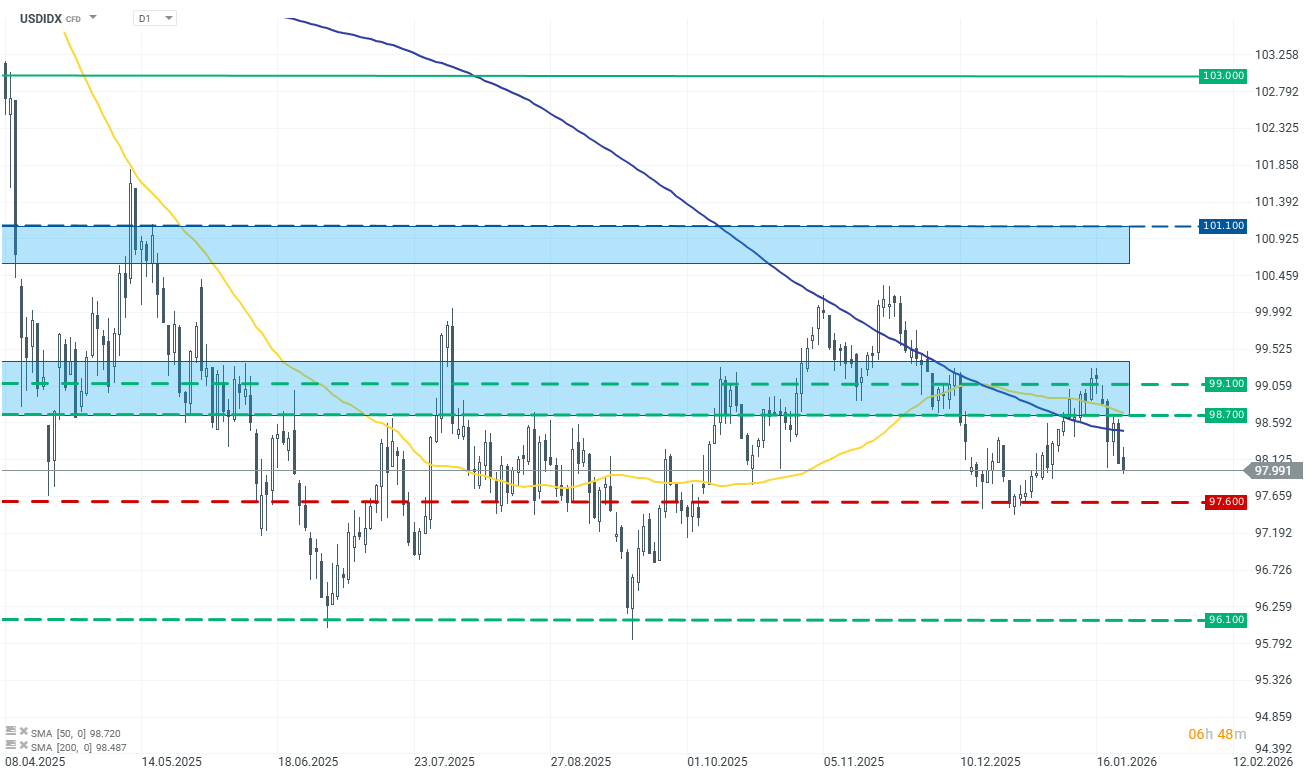

Long position on the USDIDX index

TP1: 98.700

TP2: 99.100

SL: 97.600

Opinion:

Sentiment around the US dollar has been clearly negative in recent days. Investors have reduced exposure to the US currency in response to escalating international tensions and announcements of potential tariffs on the European Union. As a result, the dollar weakened by more than 1.0% on a weekly basis.

In our view, however, a large part of this negative news has already been priced in. Experience from previous periods shows that Donald Trump’s administration often softens earlier, confrontational statements, which could support a short-term improvement in sentiment toward the dollar.

In addition, a key factor for USD performance will be Wednesday’s Federal Reserve meeting, particularly Jerome Powell’s press conference. Recent comments from the Fed Chair point to a strong commitment to central bank independence, which may be interpreted by the market as a signal of monetary policy stability. A potentially more hawkish tone from the Fed could provide additional support for the US currency.

In light of the above, we recommend opening a long position at the market price.