UnitedHealth Group Q3 2025 Results

UnitedHealth Group once again confirmed its leading position in the health insurance and medical services sector, delivering results well above market expectations. Despite cost pressures and regulatory changes, the company continues to maintain stable growth and high profitability.

Financial Results

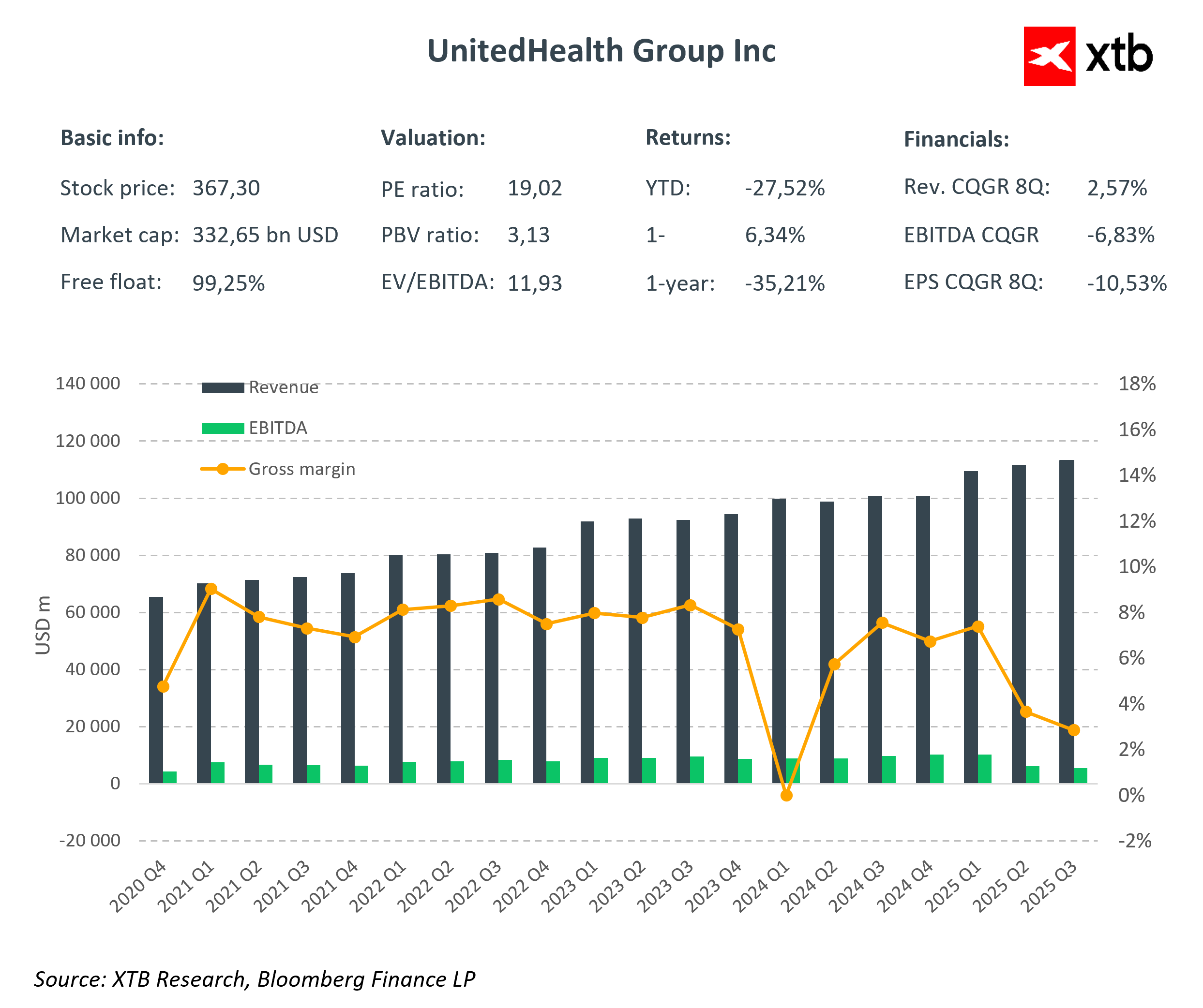

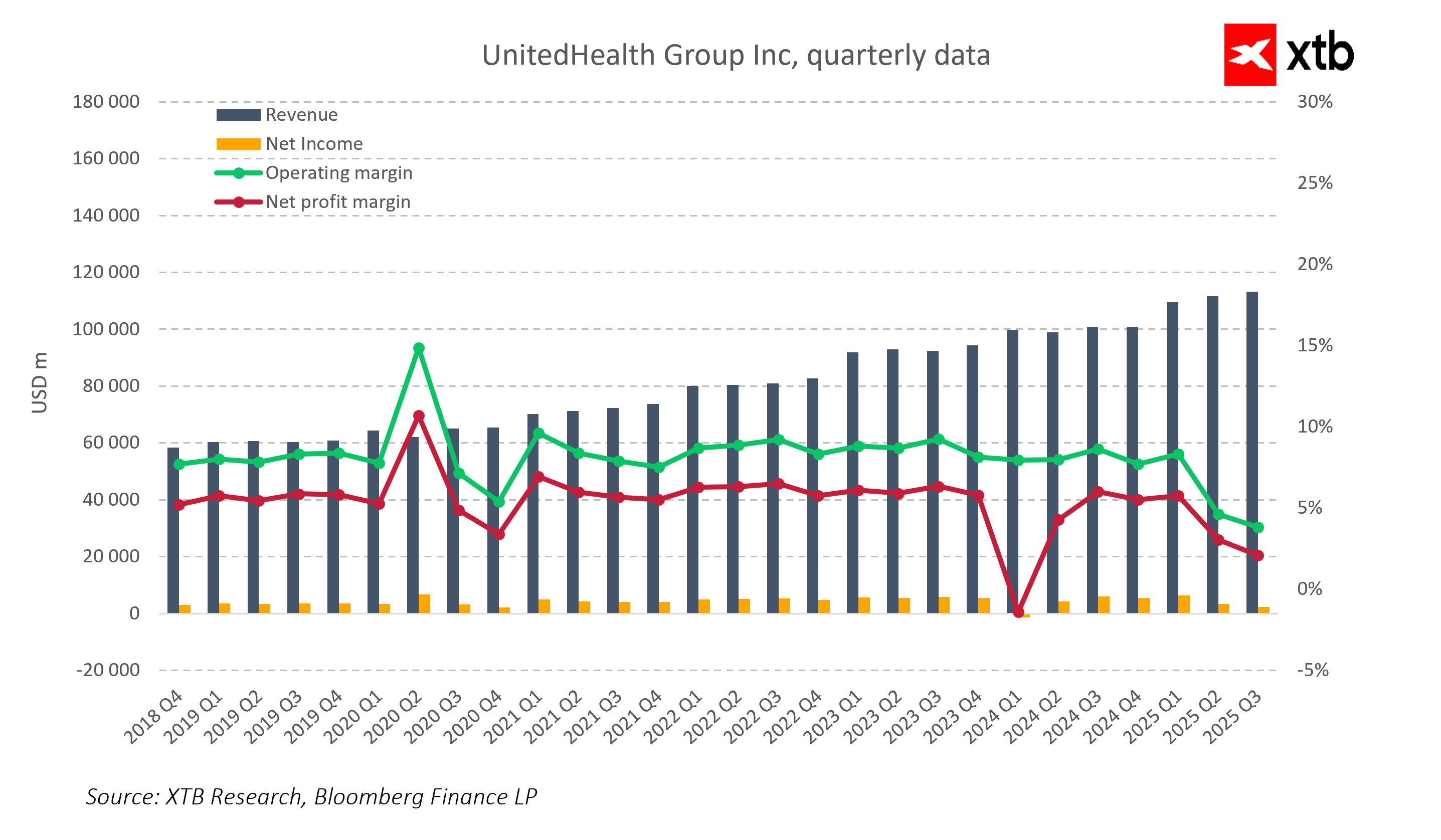

In Q3 2025, UnitedHealth generated revenues of USD 113.2 billion, representing a 12 percent year-on-year increase. The UnitedHealthcare segment recorded revenues of USD 87.1 billion, up 16 percent year-on-year. Growth was driven primarily by the Medicare & Retirement and Community & State programs, which increased membership and strengthened the company’s market position.

The Optum segment also saw solid growth, with revenues rising 8 percent to USD 69.2 billion. Optum Rx, responsible for pharmacy benefits management, performed particularly well, increasing revenues by 16 percent to USD 39.7 billion due to growing prescription demand and integrated healthcare services. Optum Health maintained stable revenues at USD 25.9 billion, demonstrating the resilience of the company’s operating model in a volatile market.

Earnings per share (EPS) stood at USD 2.59, while adjusted EPS reached USD 2.92, surpassing the analyst consensus of USD 2.79. The medical loss ratio (MLR) remained at 89.9 percent, and the net margin was 2.1 percent. Operating cash flow reached USD 5.9 billion, more than double the net income.

Notably, UnitedHealth raised its full-year 2025 adjusted EPS guidance to at least USD 16.25 per share, up from the previous forecast of USD 16.00.

Medicare Advantage Segment

The Medicare Advantage segment remains a key driver of UnitedHealth’s growth. In Q3, membership in these plans increased, significantly boosting UnitedHealthcare’s revenues. The rising popularity of Medicare Advantage plans stems from their advantages over traditional Medicare, including better care coordination, broader service coverage, and more favorable financial terms.

The company continues to invest in service quality improvements and process digitization, enabling cost control and maintaining stable margins. High plan quality ratings, known as Star Ratings, further enhance competitiveness and UnitedHealth’s market position.

Market Reaction and Stock Context

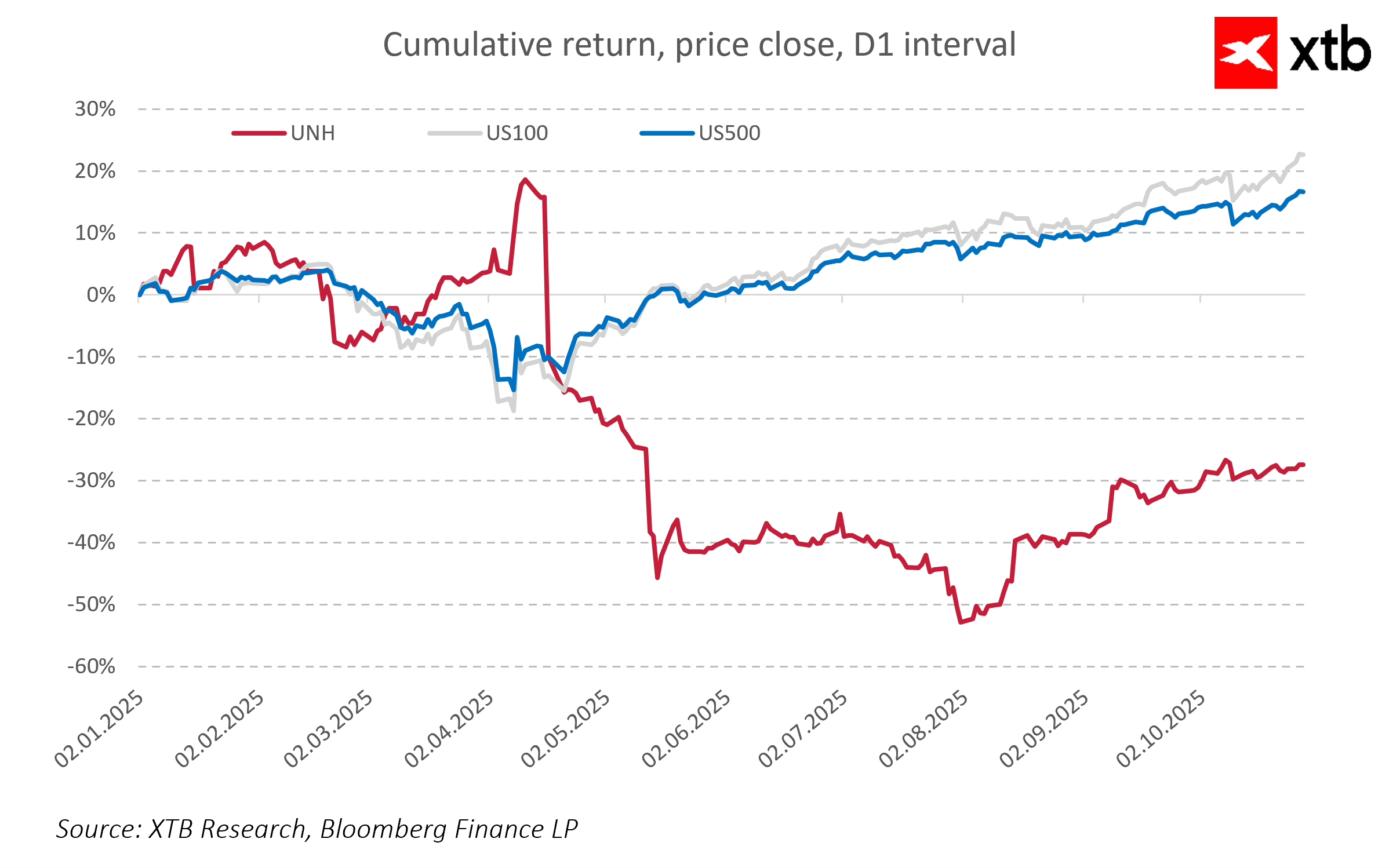

The EPS guidance raise triggered a positive market reaction, with UnitedHealth shares rising more than 4 percent in early trading. After the initial surge, the stock retraced slightly.

Despite this short-term improvement, year-to-date performance remains significantly weaker than the broader market. Since the beginning of 2025, UNH shares have fallen approximately 30 percent, while the S&P 500 has gained over 15 percent. The decline reflected concerns over rising medical costs, regulatory uncertainty, and changes to the Medicare program.

However, the company’s fundamentals are beginning to stabilize and improve. Steady growth in UnitedHealthcare and Optum, cost control, and rising demand for Medicare Advantage plans suggest operational recovery. Analysts emphasize that the high-quality customer base, Optum’s efficiency, and a strong balance sheet could support gradual stock price recovery in the coming quarters.

Summary

Q3 2025 results confirm the resilience and effectiveness of UnitedHealth’s business model. The company is able to generate profits even in a challenging market environment. The growing contribution of the Optum segment, UnitedHealthcare’s stability, and the positive momentum in Medicare Advantage provide a foundation for further growth and stock price recovery in the coming months.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.