XAG/USD hits fresh record highs above $99.00

- Silver price reached a fresh high of $99.39 on Friday

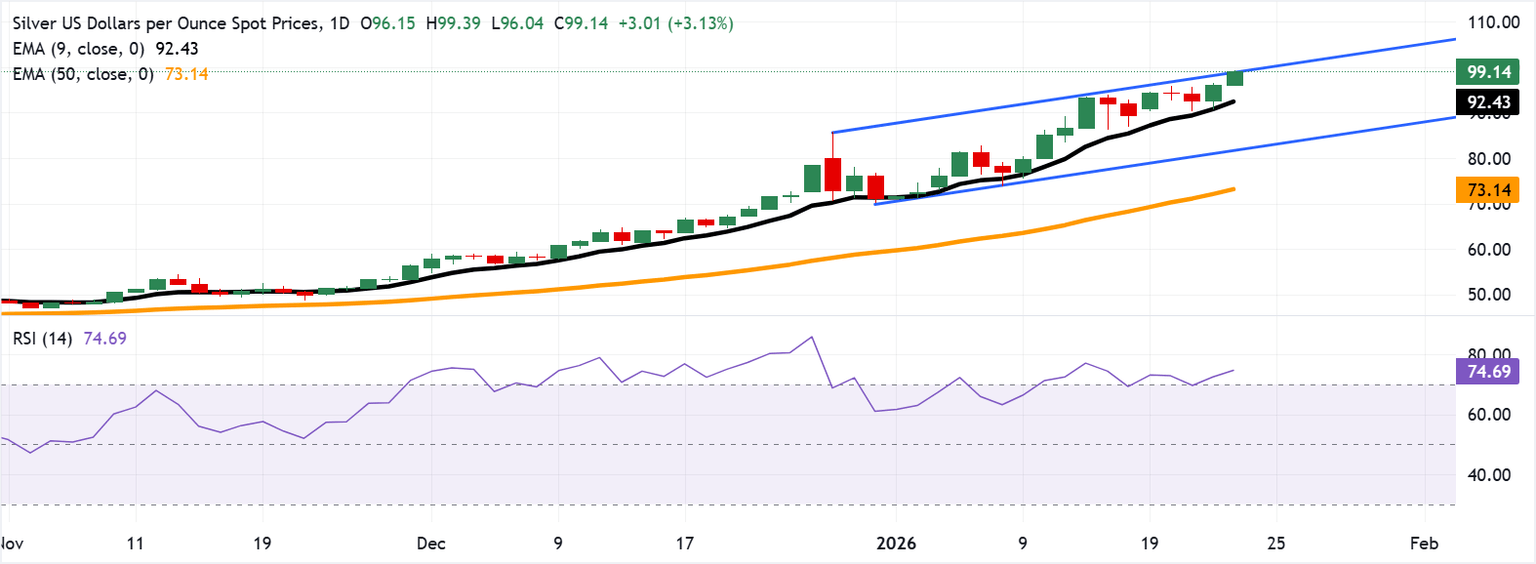

- XAG/USD stays above the rising nine-day EMA, with the advancing 50-day EMA supporting the medium-term trend.

- The 14-day Relative Strength Index at 74.66 suggests stretched momentum and potential consolidation.

Silver price (XAG/USD) extends its gains for the second successive session, trading around $99.10 per troy ounce during the Asian hours on Friday. The XAG/USD pair hit a fresh high of $99.39 amid persistent bullish bias, indicated by the technical analysis of the daily chart timeframe, as the price of the precious metal rises to near the upper boundary of the ascending channel pattern.

Silver price holds above the rising nine-day EMA, while the 50-day EMA continues to advance and underpins the medium-term trend. Trend strength is confirmed by the widening gap between the 9-day EMA and 50-day EMA, keeping bulls in control.

The 14-day Relative Strength Index (RSI) at 74.66 (overbought) flags stretched momentum that could precede consolidation. Overbought conditions could trigger a pause, but the uptrend remains intact while above the short-term average. A defended dip would keep the topside bias intact and open scope for extension above the upper ascending channel boundary around $99.80, followed by the psychological level of $100.00.

Should price pull back, initial demand could emerge near the nine-day EMA at $92.42. A daily close below the short-term average would risk a correction toward the lower boundary of the ascending channel around $82.00. Further declines would put downward pressure on the Silver price to navigate the region around the 50-day EMA at $73.14.