XAU – Gold Surges over 2% With a View to $5,100 Amid Weaker USD

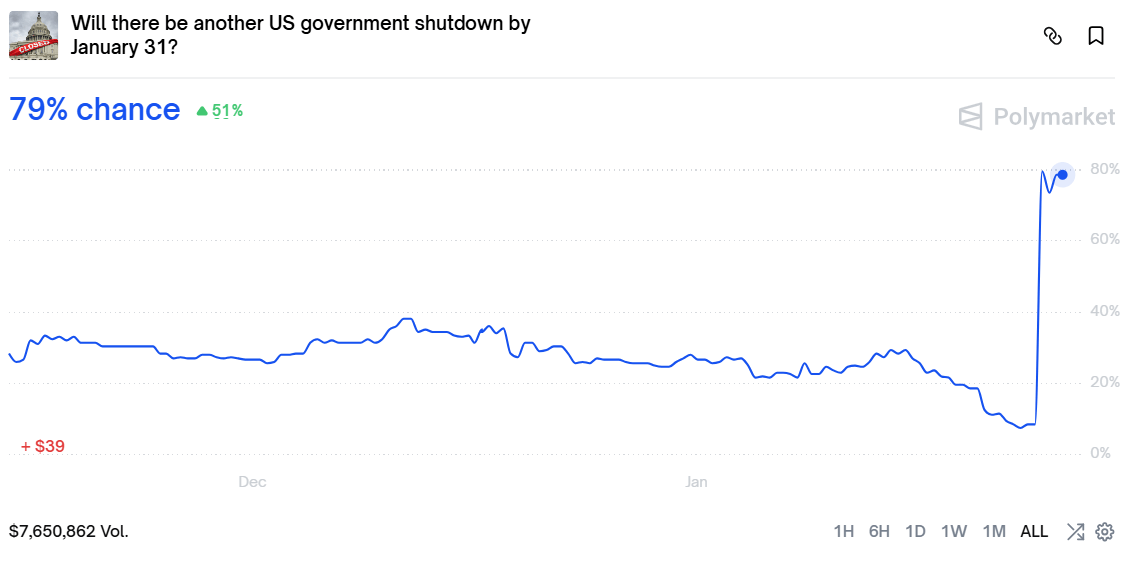

Gold prices are up more than 2% today, climbing to nearly $5,100 per ounce as the U.S. dollar weakens. Polymarket is now pricing in an 80% chance of a U.S. government shutdown after Senate Democrats, led by Chuck Schumer, vowed to block a spending bill unless funding for the Department of Homeland Security (DHS) is removed. This follows the killing of an American nurse in Minnesota by a Border Patrol agent, intensifying opposition concerns that DHS is abusing its powers.

- The US president, Donald Trumps stays for huge rate cuts from current 3.5% to 1% level, and now leading in Fed chair race, BlackRock’s Rick Rieder remarts signals he is very dovish, commenting that cutting rates may even help fighting inflation.

- Broader uncertainty, destabilization and political polarization in the U.S. is another factor weighing on the dollar’s standing and directing market attention to the country’s rising debt burden, which is approaching $39 trillion and is expected to keep growing.

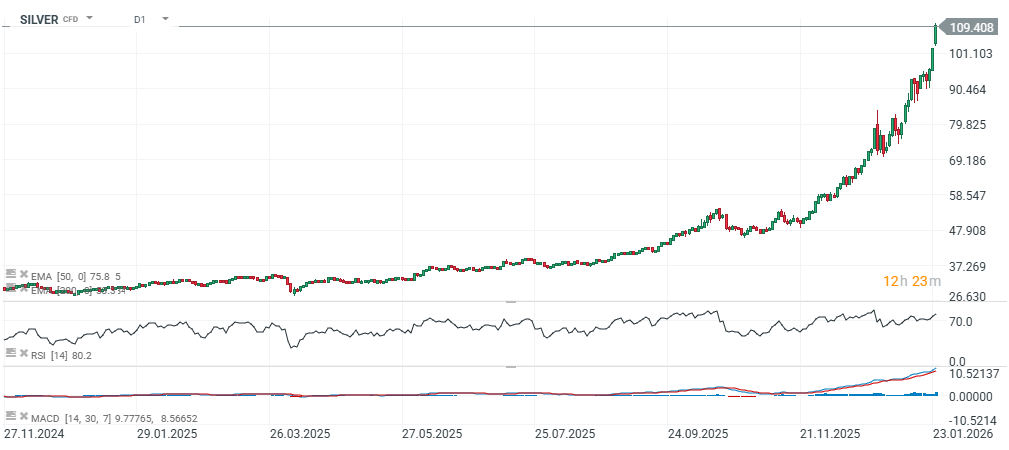

- A natural consequence of this environment is rising interest in precious metals -especially gold, which for centuries has served as a “safe haven,” preserving value over time. Capital is flowing into gold today, while the dollar is being sold (the U.S. Dollar Index futures contract, USDIDX, is slipping below 97).

In recent months, it has been hard to shake the impression that gold is not only pricing in the “past loss of purchasing power of fiat currencies,” but also already “consuming” the value by which currencies may weaken in the years ahead—if central banks come under pressure to keep interest rates structurally lower despite elevated inflation, in order to avoid cracks in the fiscal system.

Source: Polymarket

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.