Apple Shares Gain After Earnings, Driven by Strong iPhone Sales

Apple (AAPL.US), the third-largest company in the U.S., reported its Q4 2025 results today. The stock rose modestly after the release — by just under 2%. Both revenue and earnings per share beat Wall Street expectations. The biggest surprise by far was the strength of iPhone sales in China and, more broadly, the very strong growth in iPhone revenue overall. Notably, Apple’s China sales had been weak over the past three years, making the current rebound an outright surprise for analysts. Outside of Apple’s report, Visa (V.US) also released results, with its shares down about 1.5%, while storage and data media maker SanDisk (SNDK.US) is up nearly 14%.

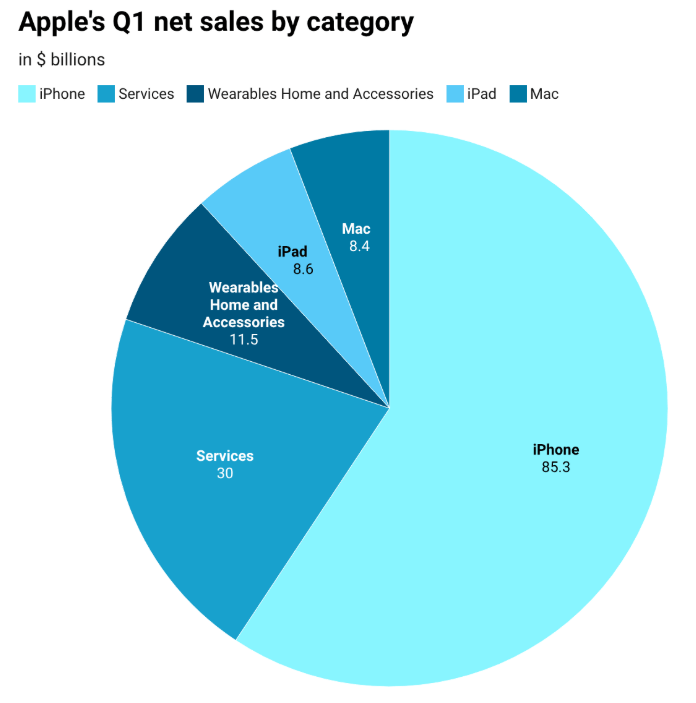

Apple Q4 2025 results

- EPS: $2.84 (+18% YoY, a new all-time EPS record); $42.1B net income

- Products revenue (total): $113.74B vs $107.69B est. (+16% YoY)

- iPhone revenue: $85.27B vs $78.31B est. (+23% YoY)

- Services revenue: $30.01B vs $30.02B est. (+14% YoY)

- iPad revenue: $8.60B vs $8.18B est.

- Mac revenue: $8.39B vs $9.13B est.

- Wearables, Home & Accessories revenue: $11.49B vs $12.13B est.

- Americas revenue: $58.53B vs $59.06B est.

- Greater China revenue: $25.53B vs $21.82B est. (+38% YoY)

- Operating expenses: $18.38B vs $18.18B est.

- Operating cash flow: approx. $54B

- Installed base: over 2.5B active devices

- Dividend: $0.26 per share

Outlook

- Apple expects 13–16% YoY revenue growth in the current quarter (Q1 2026).

Apple stock (D1)

Apple shares are trading around $262 in after-hours. In its commentary, the company said it is pleased with record iPhone sales (with demand described as the strongest in its history across the markets where Apple operates) as well as strong Services performance.

Source: xStation5

iPhone and Services revenue together exceeded $115B in Q4.

Source: Apple, Datawrapper

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.