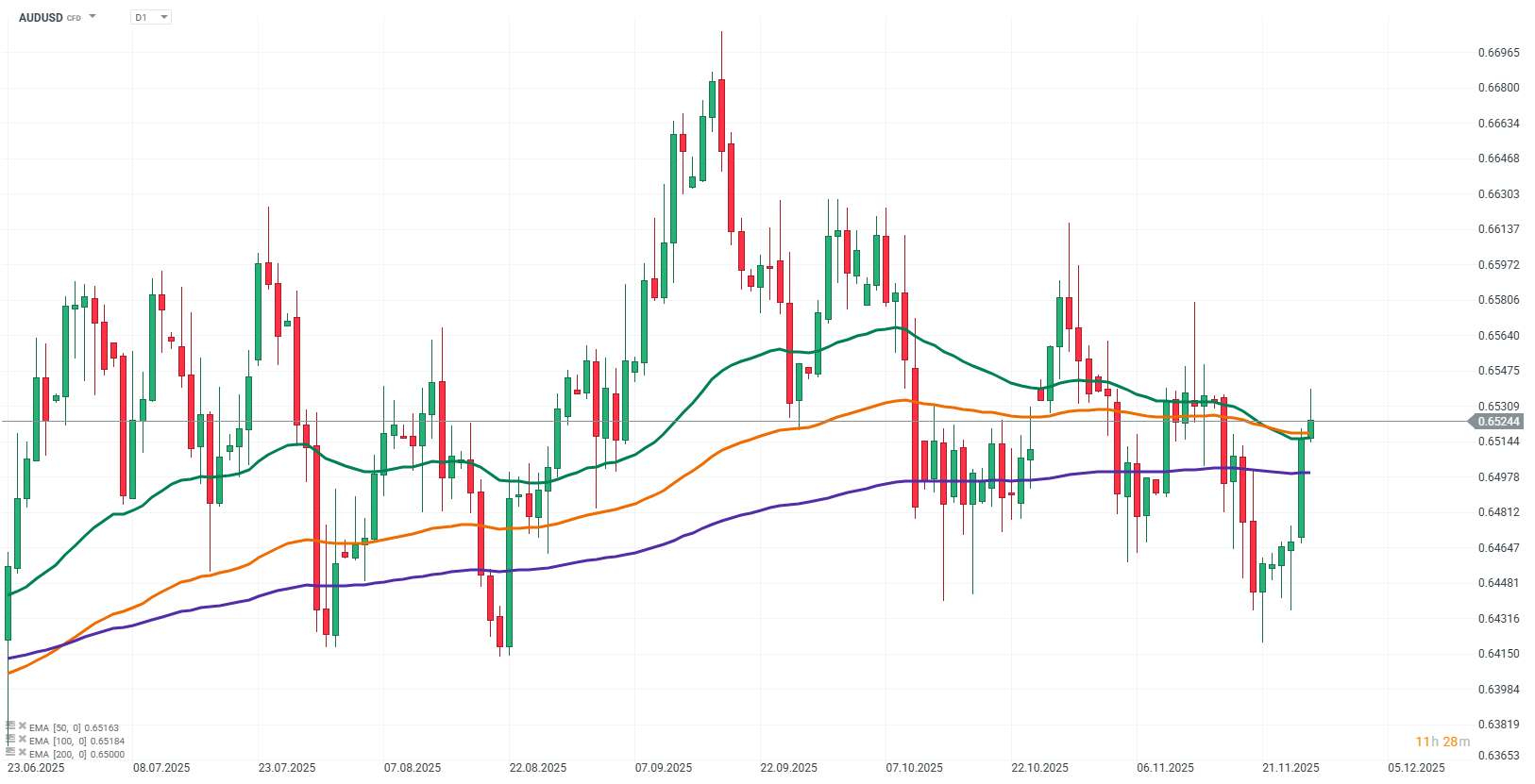

Chart of The Day – AUD/USD

What is currently influencing the AUD/USD exchange rate?

The AUD/USD pair is moving higher today, with market dynamics shaped primarily by macroeconomic factors coming from both Australia and the United States. The pair is currently trading in the 0.6520–0.6540 USD range per Australian dollar. Persistently high inflation in Australia strengthens expectations that the Reserve Bank of Australia will not rush to cut interest rates, which supports the value of the Australian currency. At the same time, the US dollar is weakening, as investors increasingly assume that the Federal Reserve may soon shift toward a more accommodative monetary policy stance. The combination of these factors helps sustain the upward trend in the AUD/USD pair.

Source: xStation5

What is driving the AUD/USD today?

High inflation in Australia and RBA policy

The latest inflation readings from Australia have once again surprised markets with their strength, showing that price pressures remain significantly higher than previously expected. Core inflation also remains above the central bank’s target, reinforcing the belief among investors that the RBA is unlikely to ease monetary policy in the near term. Keeping interest rates unchanged creates favorable conditions for further strengthening of the AUD. Inflation data have also improved the technical picture, increasing investor demand for the Australian currency.

Rising expectations for Fed rate cuts and a weaker US dollar

In the US macroeconomic environment, expectations are growing that the Federal Reserve may soon take a more dovish stance. The increasing likelihood of a rate cut reduces the attractiveness of the US dollar, which in turn supports developed-market currencies such as the AUD. This divergence in the outlook for monetary policy between the two central banks currently works in Australia’s favor. Additional support comes from improved global sentiment, which encourages flows into more cyclically sensitive currencies.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.