Chart of The Day – JP225

Japan’s Nikkei 225 index surpassed the 50,000 mark for the first time in history on Monday, closing up 2.46% at 50,512 points. The rally reflected optimism over easing U.S.–China trade tensions and strong global risk appetite following record gains on Wall Street.

Investor sentiment in Japan was further supported by expectations that the Bank of Japan will maintain its ultra-loose monetary policy at this week’s BoJ meeting, as well as by political backing for Prime Minister Sanae Takaichi’s pro-growth reforms. Her government’s planned expansionary fiscal measures have drawn comparisons to “Abenomics,” raising hopes of escaping decades-long deflation. The yen remains unusually strong today, gaining around 0.10–0.20% against other G10 currencies, while USDJPY is down 0.17% to 152.820.

Risk appetite in the Asia-Pacific region was also buoyed by news that the U.S. abandoned plans to impose 100% tariffs on Chinese imports. Investors expect Prime Minister Takaichi to meet former President Trump during his visit to Japan later this week.

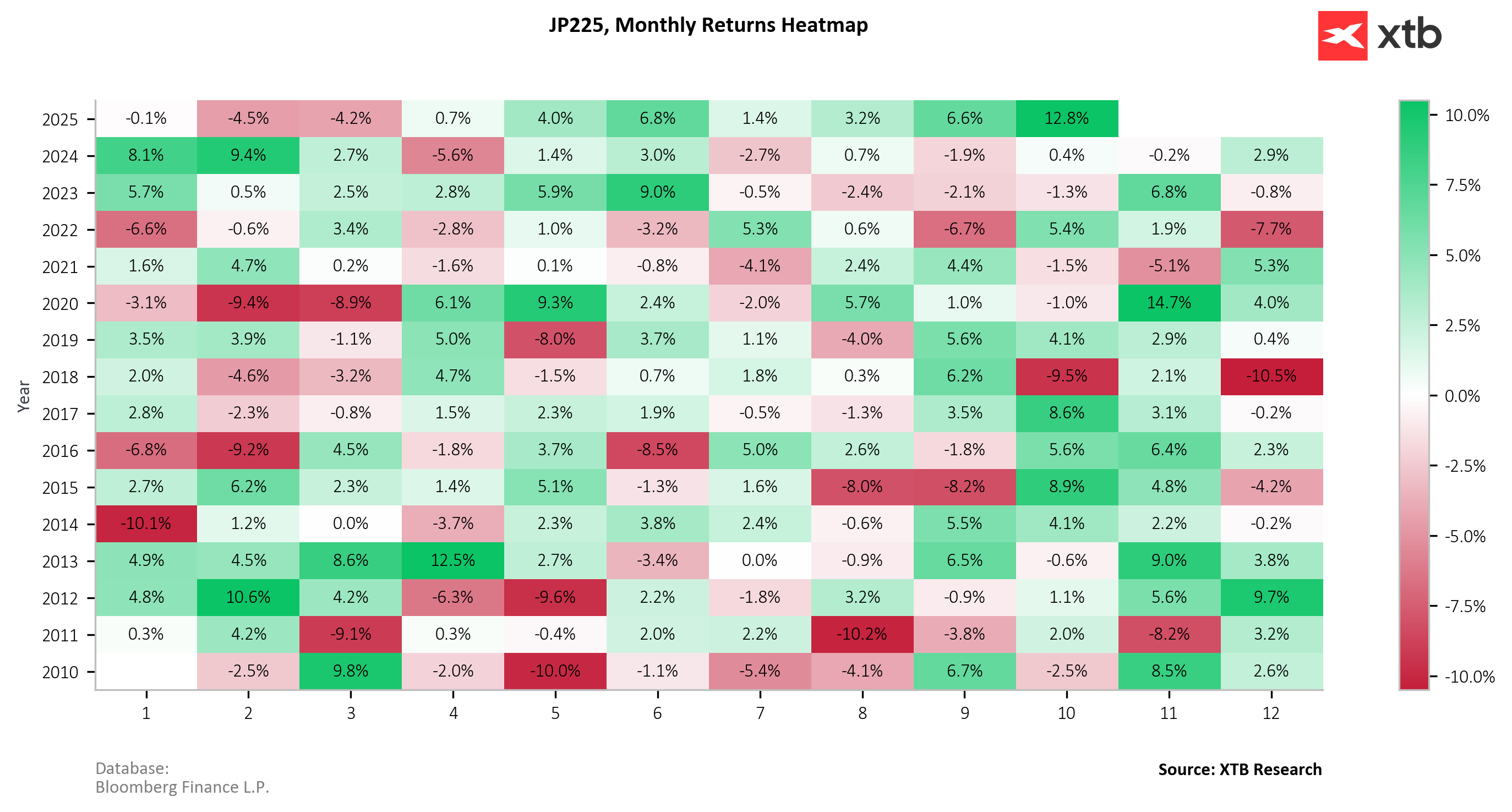

On a monthly basis, the JP225 index has logged its strongest month since data collection began in 2010, rising 12.8% in just one month (October).

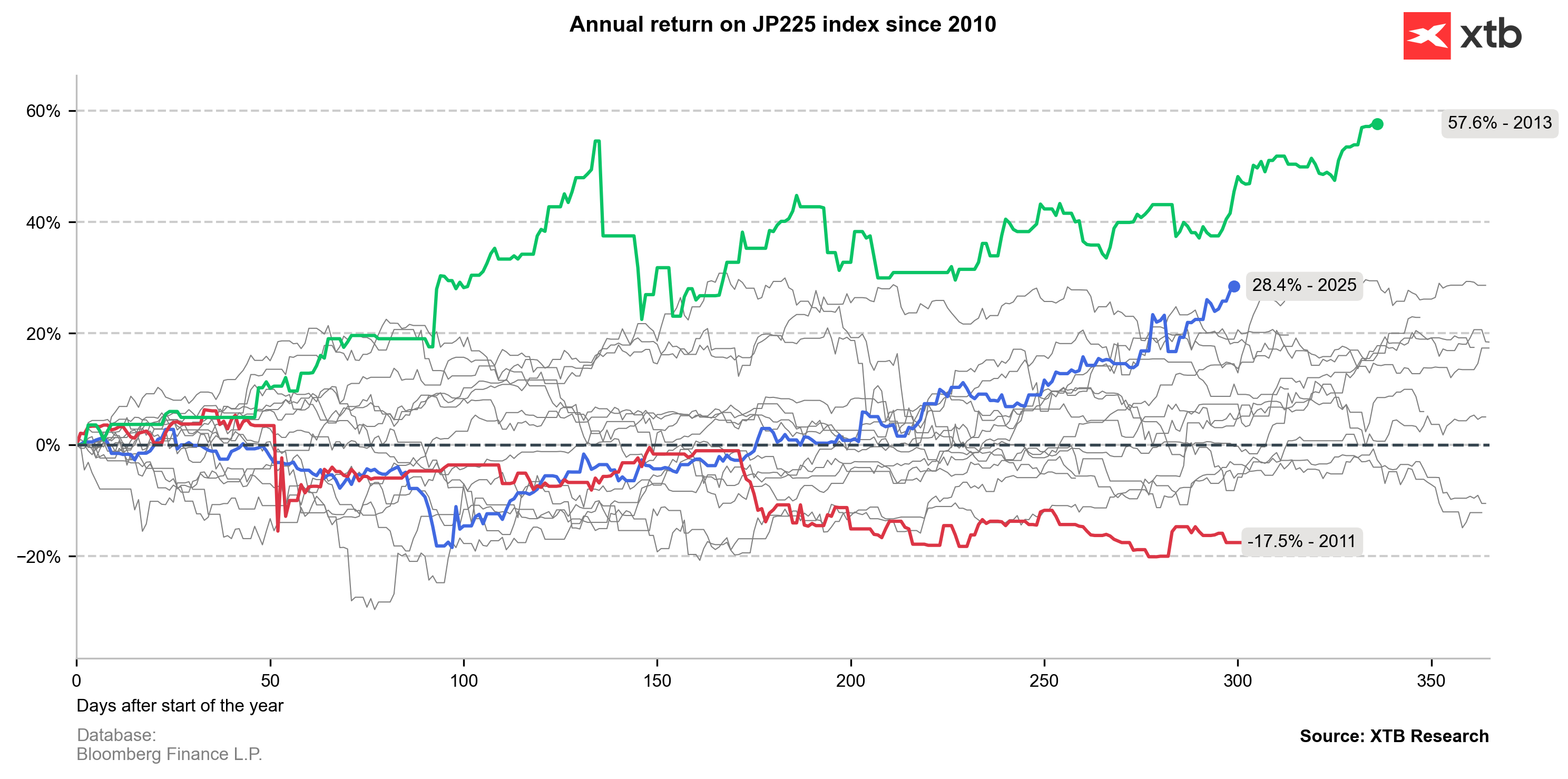

On a yearly basis, 2025 marks the second strongest year of gains in the past 15 years, although it’s worth noting that the rally accelerated only around midyear.

JP225 (D1 interval)

Surpassing the historic 50,000-point threshold — more than three decades after the 1989 bubble-era peak — signals a gradual revival of investor confidence in Japan’s economy. Nikkei 225 futures (JP225) traded on the XTB platform had already crossed 50,000 points late last week, following the close of Japan’s cash session.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.