Chart of The Day – Nasdaq 100

Global equity sentiment is clearly weaker today. Nasdaq 100 futures (US100) are down close to 0.7% as markets grapple with renewed uncertainty around US Europe trade relations.

- The current base case in the market is that tariffs on European goods could rise by 10% by February 1, and potentially to 25% on June 1 if Europe continues to block the United States from purchasing Greenland. Hardening transatlantic negotiations also increase the risk of penalties and higher taxes targeting US technology companies operating in Europe.

- After the US session, Netflix (NFLX.US) is set to report earnings. If the results disappoint, the market could see another downside impulse. Netflix shares are down nearly 30% from this year’s highs and have fallen more than 6% year to date. Later in the day, investors may also focus on a potential US Supreme Court decision regarding tariffs.

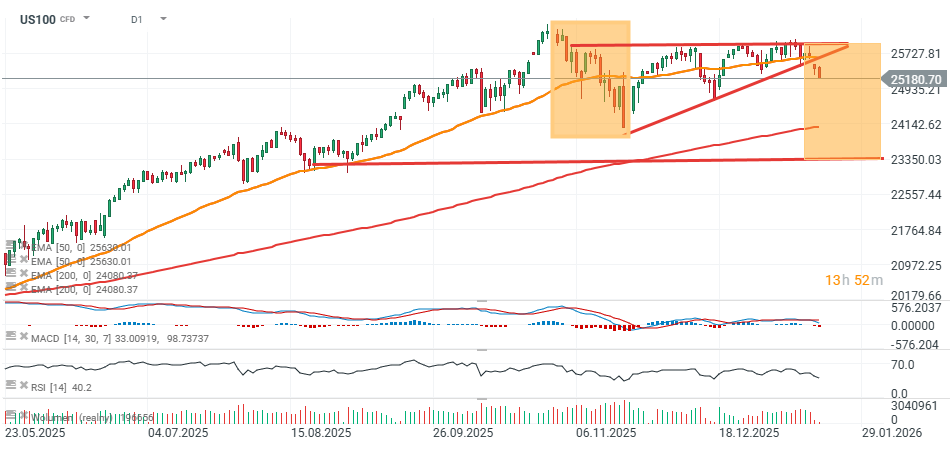

US100 (D1 timeframe)

Looking at the US100 chart, the index has broken to the downside from a rectangular triangle pattern. If the decline were to mirror the prior bearish impulse (a continuation move), it could imply a pullback toward the 23,350 area, where notable price reactions were seen around late July and early August 2025. The index has also dropped decisively below the 50 day exponential moving average on the daily chart (EMA50, orange line), while MACD and RSI indicators point to selling pressure remaining in control.

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.