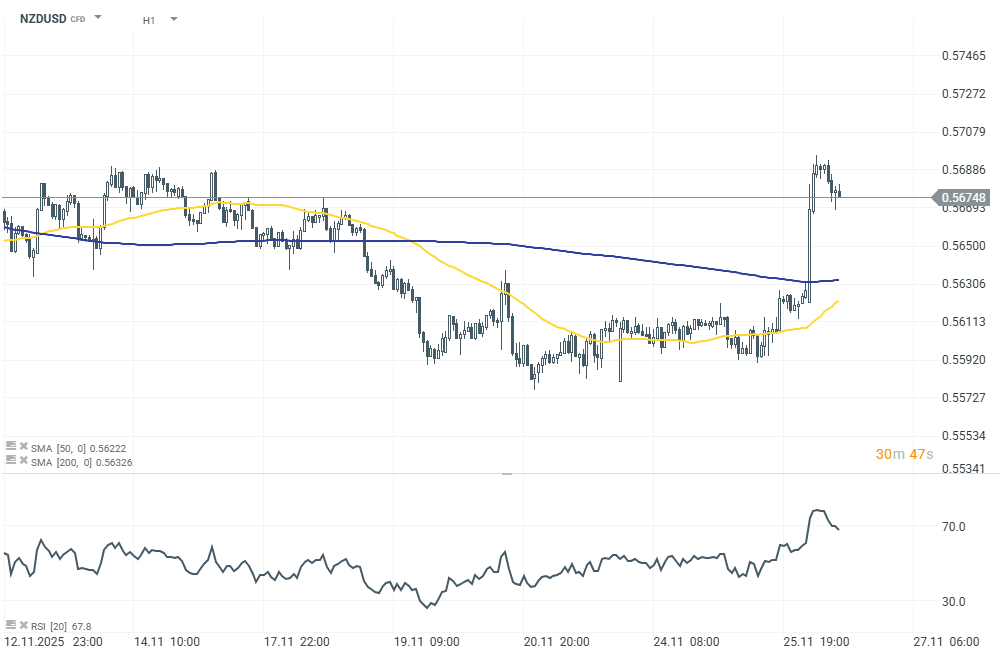

Chart of The Day – NZD/USD

The Reserve Bank of New Zealand (RBNZ) cut the official cash rate (OCR) by 25 bp to 2.25%, in line with expectations, likely marking the final step in the easing cycle that began in 2024.

The decision was made in an environment where CPI inflation stands at 3%, the upper end of the 1–3% target band. Forecasts project a decline toward 2% by mid-2026. New Zealand’s economy contracted by 0.9% in Q2. However, the RBNZ believes the decline was driven by temporary factors and seasonal distortions. The latest projections suggest a moderate rebound. The committee voted 5 to 1 in favor of a 25 bp cut while stressing that future decisions will depend on inflation dynamics and economic activity.

During the press conference, acting Governor Christian Hawkesby described the decision as the beginning of a return to a more “boring” monetary-policy environment. Hawkesby hopes that by 2026 the RBNZ will disappear from front-page headlines, inflation will move closer to 2%, and economic growth will normalize. He emphasized that risks to the forecasts are balanced: global inflation and political uncertainty remain challenges, but domestic inflation expectations are becoming more firmly anchored and the labor market shows signs of stabilizing. As he stated, every option remains “on the table,” but the central projection assumes no further cuts.

Markets interpreted the combination of a dovish move and balanced rhetoric as less dovish than expected, triggering a sharp strengthening of the New Zealand dollar. Following the announcement and press conference, the NZD strengthened by about 1.10% against the U.S. dollar, becoming the strongest currency in the G10 basket. The move reflects investors’ belief that the easing cycle is nearing its end and that the RBNZ is signaling macroeconomic comfort.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.