Chinese Inflation Turns Positive

In October 2025, China recorded its first positive consumer price inflation (CPI) reading since June, with CPI rising 0.2% year-on-year, slightly above market expectations of zero growth. This indicates that the deflation present for most of the year is starting to ease, driven by rising consumer demand and the effects of economic stimulus measures, particularly during the national holiday period. On a monthly basis, CPI also increased by 0.2%, signaling a stabilizing trend in consumer prices.

At the same time, producer price inflation (PPI) remains in negative territory, falling 2.1% year-on-year, although slightly less than the forecast of -2.2%. This shows that deflationary pressure in the industrial sector persists, albeit at a diminishing rate, and has continued for over three years. Food prices fell 2.9% year-on-year, despite a modest 0.2% increase on a monthly basis, contributing to the moderate overall inflation dynamic in China. Taken together, these figures suggest that the Chinese economy is gradually recovering from a prolonged period of deflation, with stimulus policies focused on boosting domestic demand beginning to take effect.

The stabilization of consumer inflation in October indicates that the risk of a sudden rise in prices in the short term remains low. In practice, this allows the People’s Bank of China to maintain a loose monetary policy, which can further support consumption and investment. However, the situation requires continued monitoring, as ongoing producer deflation points to challenges in the industrial sector that could impact global supply chains.

The rise in China’s CPI also has a direct effect on global equity markets. A positive reading after a long period of deflation signals a revival in domestic demand, potentially boosting the growth of consumption-dependent companies. This improves investor sentiment, particularly on Asian stock exchanges, and positively affects global indices, increasing risk appetite. Additionally, moderate CPI growth reduces concerns over aggressive interest rate hikes, which could otherwise constrain asset valuations, further supporting equity markets. However, persistent producer deflation remains a factor that investors closely watch when assessing economic growth prospects.

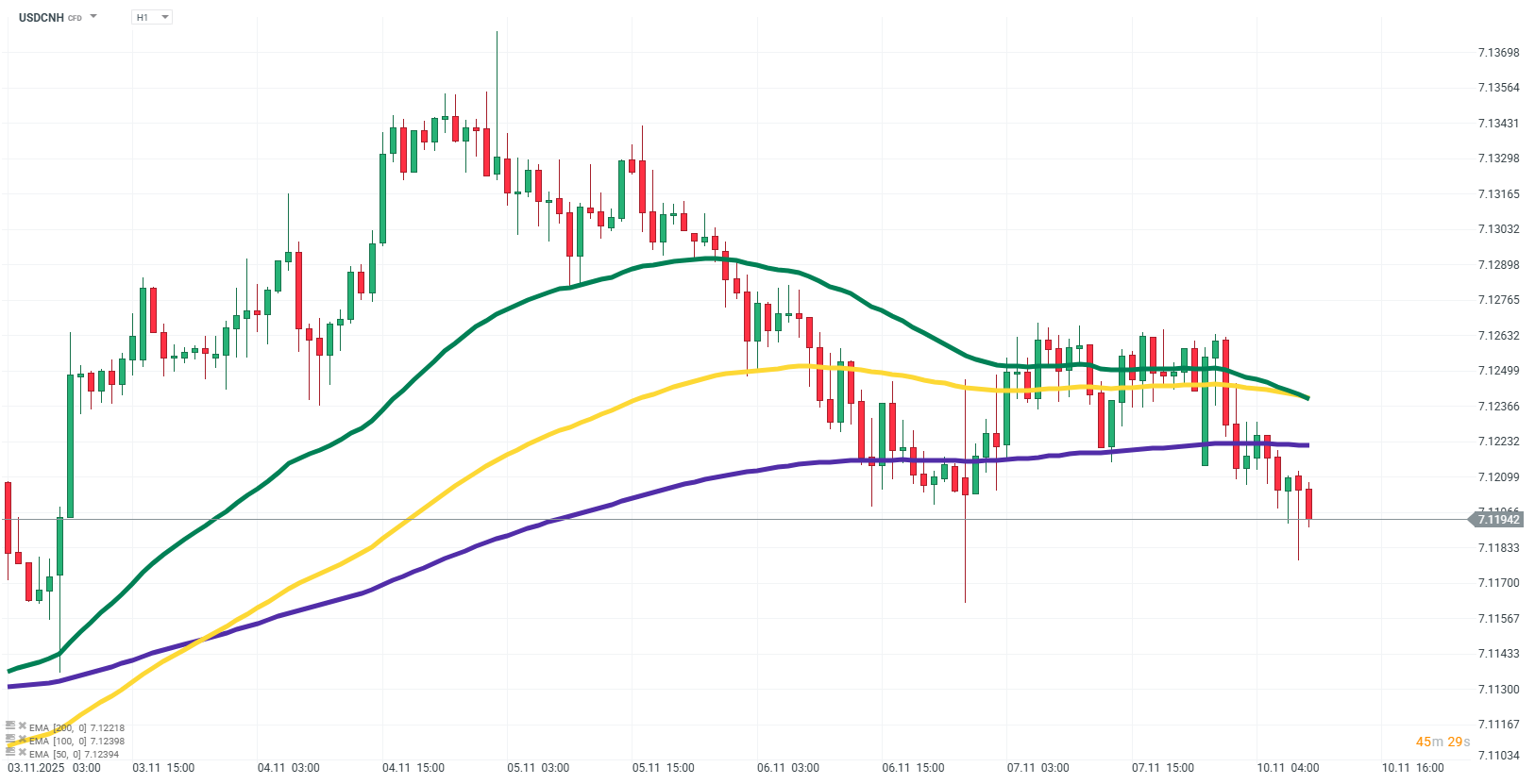

China’s inflation also plays an important role in the dollar exchange rate and global capital flows. A positive signal from rising consumer inflation increases the attractiveness of investing in Chinese assets, potentially leading to capital inflows into China and strengthening the yuan against the dollar. At the same time, more stable economic prospects reduce risk aversion, supporting investment in emerging markets and influencing global capital trends.

It is also worth noting which asset classes typically benefit from higher CPI in China. Consumer stocks and commodities, particularly industrial and energy metals, usually see the strongest gains as they benefit from rising domestic demand and higher prices. Treasury bonds offer higher yields, serving as a safer haven compared with more volatile assets. Positive inflation signals also support equity markets in emerging economies, which often benefit from China’s growing consumption.

October’s inflation data in China point to the beginning of a consumption recovery and stabilization of consumer prices, which could support a loose monetary policy and foster positive sentiment in global markets. At the same time, persistent producer deflation reminds that industrial sector challenges remain and will be key to the sustainability of China’s economic recovery.

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.