The Overbalance analysis aims to identify three financial instruments, analysed exclusively on a four-hour interval (H4). The analysis uses only the Overbalance methodology, which allows us to determine where the trend may continue or where it may change.

Today’s analysis covers three instruments, assessed exclusively in terms of the 1:1 correction structure.

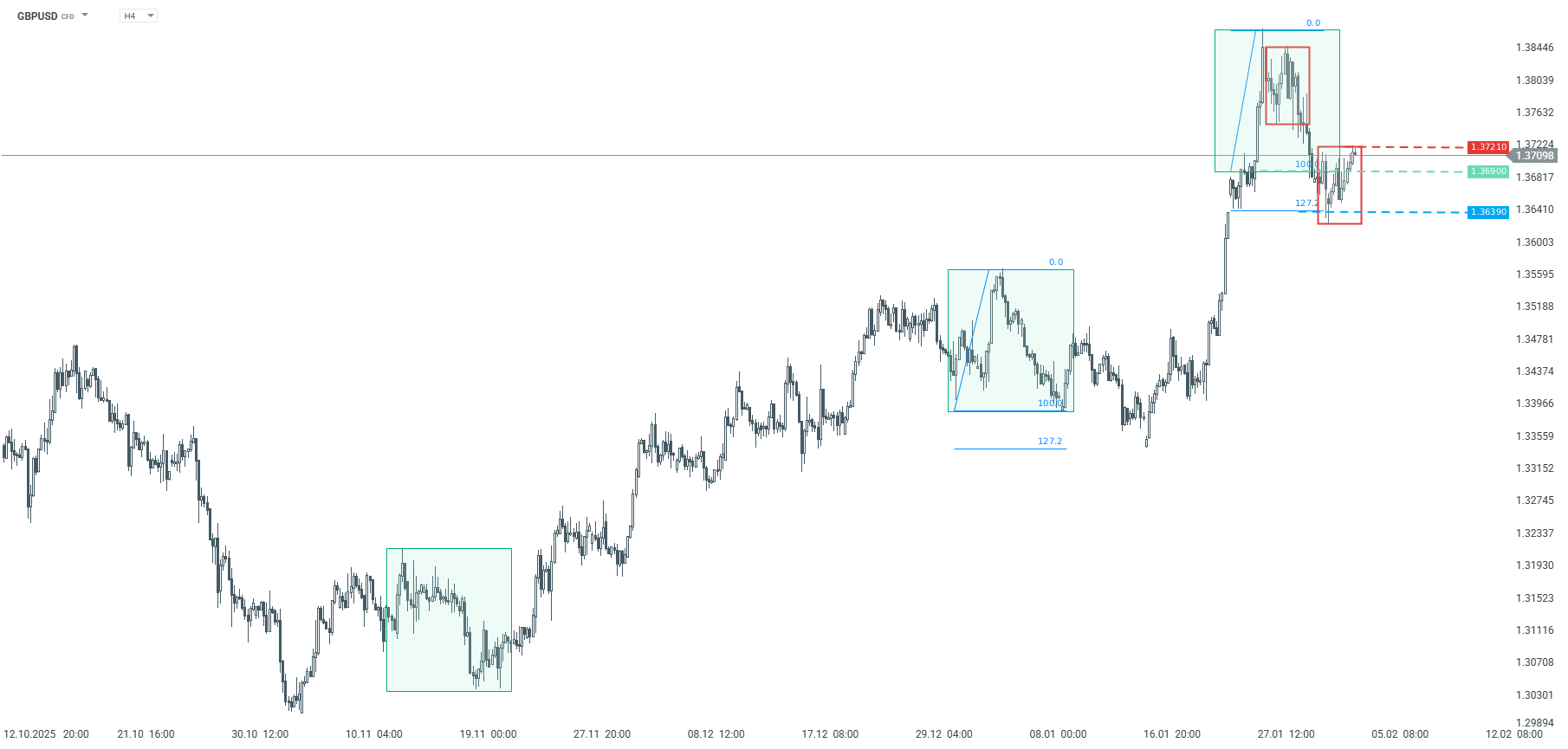

GBPUSD – H4 interval

Since November last year, the GBPUSD currency pair has been moving in an upward trend. The latest correction, although slightly larger than the previous two marked with green rectangles, did not negate the 127.2% ratio, which, according to the Overbalance methodology, means that the main trend remains upward.

Additionally, if the price manages to break above 1.3721 today, it will negate the local 1:1 downward pattern, paving the way for a continuation of the movement towards new highs. On the other hand, a break below 1.3639 will increase the risk of a deeper downward correction.

GBPUSD – H4 interval Source: xStation5

NZDUSD – H4 interval

The NZDUSD currency pair has also been on an upward trend since November last year. The latest correction was greater than the local 1:1 ratio, but it still falls within the range of the largest correction in the entire upward impulse, with a lower limit of 0.5949. As long as this level is not negated, the upward scenario remains the baseline, and additionally, the price remaining above 0.6032 supports the assumption of a continuation of the movement to higher levels.

NZDUSD – H4 interval Source: xStation5

CADJPY – H4 interval

The CADJPY currency pair has been on an upward trend for quite some time. The latest correction had exactly the same range as the first correction in the trend, i.e. the correction in October last year, which fits into the classic Overbalance structure. In addition, the price returned above the polarity of the broken smaller 1:1 geometry at 113.22, which reinforces the scenario assuming a continuation of the upward movement.

CADJPY – H4 interval Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.