Decline in Malboro Sales – Stagnation in Nicotine Sales

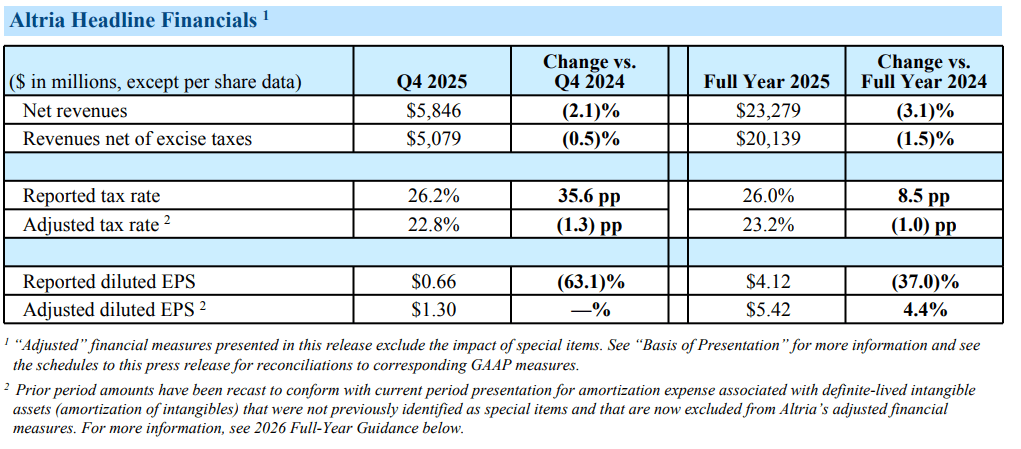

Altria Group (MO.US) announced its Q4 2025 results before the market opened (January 29, 2026). Net revenue reached $5.08 billion, down only 0.5% year-on-year compared to Q4 2024, but above the analyst consensus of $5.03 billion. Adjusted EPS was $1.30, unchanged y/y but slightly below market expectations ($1.32), which triggered a negative reaction from investors.

Source: Investor Relations of the company

For the whole of 2025, EPS grew by 4.4% to $5.42 (in the upper half of the previously announced forecast of $5.37–$5.45), with revenues of $23.3 billion (-3.1% y/y). MO shares fell 4% before the session, with the market focusing on pressure on cigarette sales volume and Marlboro’s loss of market share.

Detailed volume trends

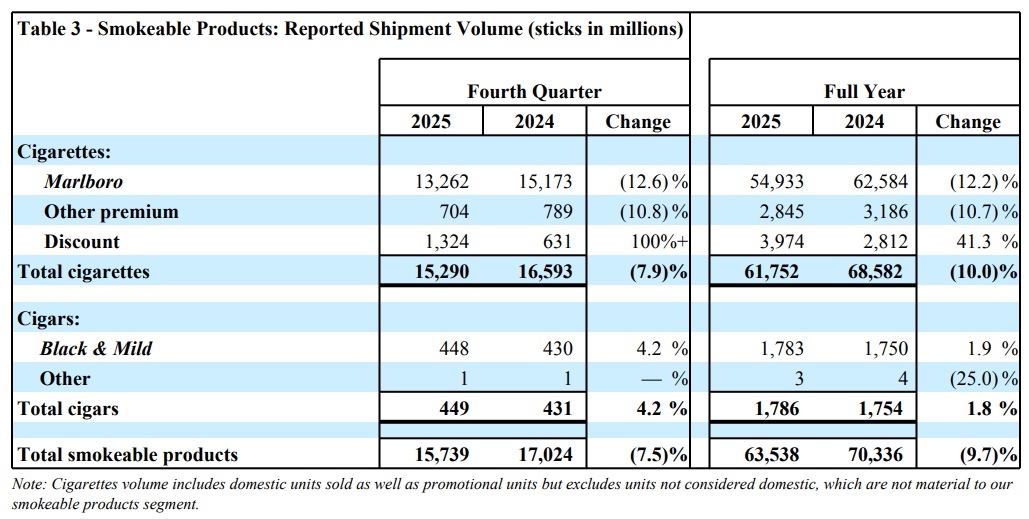

The cigarettes and cigars segment recorded a 7.5% year-on-year decline in volume. For the whole year, the decline was 9.7%. Marlboro lost 3.8% of its volume (73 million sticks) in Q4, and its market share fell to 39.8% (-1.5 p.p. y/y). Despite this, Marlboro’s average net price increased by 7.3% to USD 9.87, supporting revenues.

Source: Investor Relations of the company

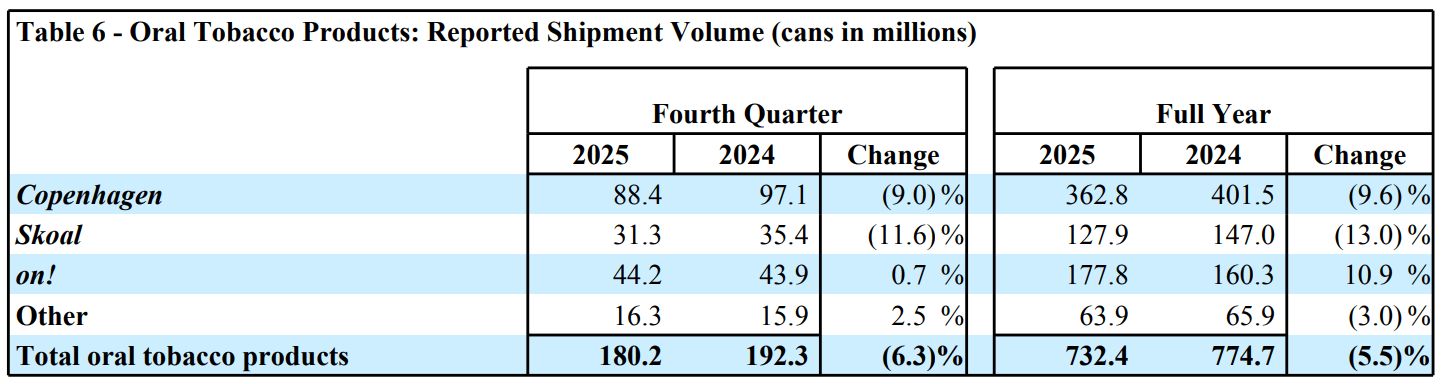

Below are the figures for alternative products (nicotine pouches): a 6.3% decline due to market share lost to ZYN and VELO. On! has a 7.7% share (-1 p.p.), but the nicotine pouch category is growing rapidly to 31.9% of the market.

Source: Investor Relations of the company

Finance, dividends, and capital allocation

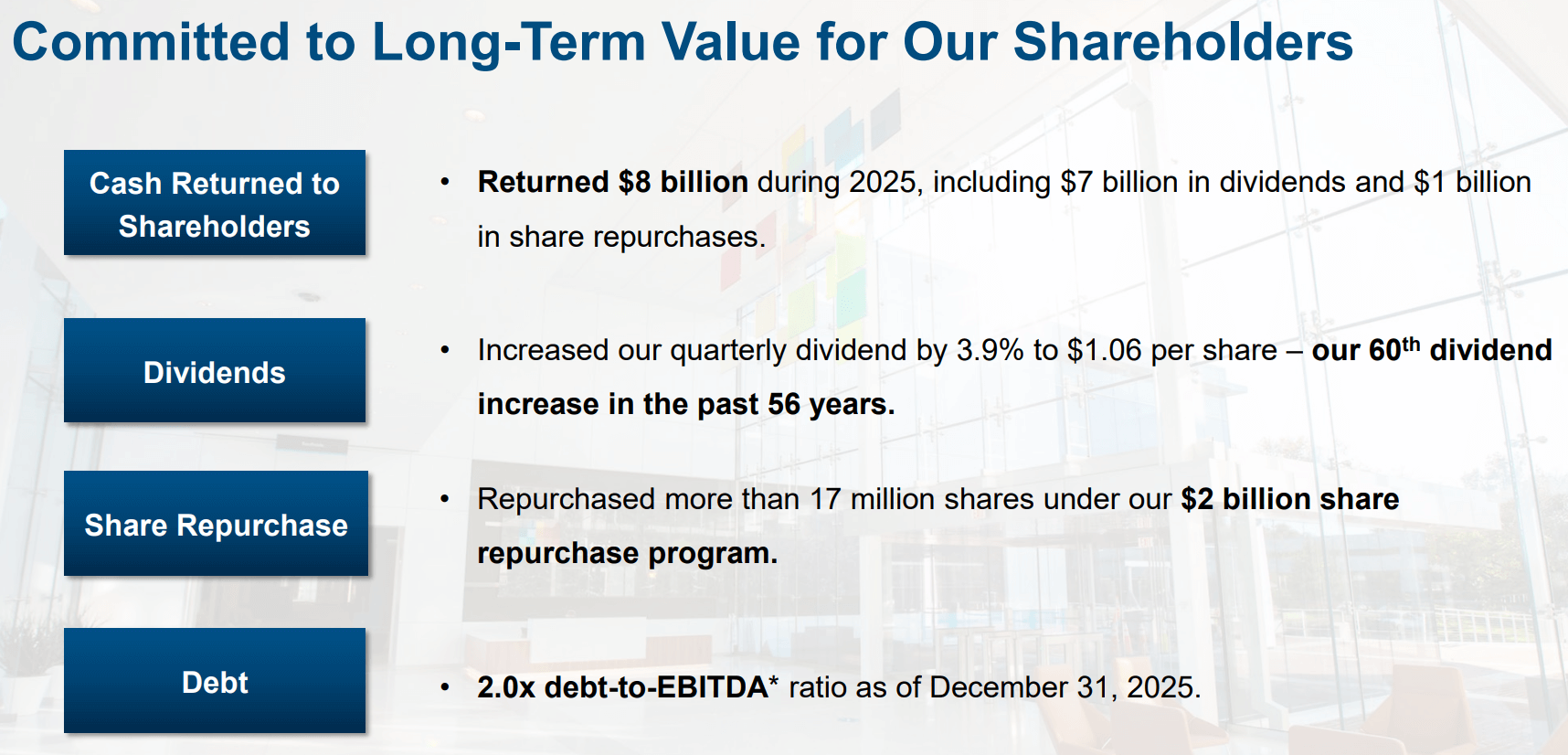

Altria Group continues its consistent policy of maximizing shareholder returns, paying dividends of $1.8 billion in the fourth quarter of 2025, for a total of $7 billion returned throughout fiscal year 2025. At the same time, the company actively pursued its share repurchase program, repurchasing 4.8 million of its own shares for $288 million at an average price of $59.56 per share – an effective strategy to support EPS in a challenging environment of declining volumes.

The share buyback program has been expanded from $1 billion to $2 billion, of which $1 billion remains available for use until the end of 2026 (expiring on December 31, 2026). This decision demonstrates the company’s strong liquidity position and management’s confidence in future cash flows, despite regulatory and macroeconomic pressures on the core cigarette business.

The capital structure remains healthy and conservative, with a leverage debt-to-EBITDA ratio of 2.0x at the end of Q4 2025, placing Altria among the most financially stable companies in the tobacco sector and providing room for further dividends and investments in the smokeless segment.

At the same time, the company launched a strategic cost optimization program called “Optimize & Accelerate,” which aims to achieve savings of at least $600 million by the end of 2029 (spread over 5 years). However, the costs of implementing the program have increased to approximately $175 million (previously estimated at $125 million), reflecting the broader scope of restructuring and operational process automation.

In practice, this means that Altria generates strong cash flows from its mature cigarette business (despite declining volumes offset by higher prices), which are effectively allocated to:

- Dividends – a key magnet for income investors (yield ~8-9% at current prices)

- Share buyback – direct increase in EPS and ROE

- Investments in the future – on! PLUS, new production capacity under CAPEX 2026 (USD 300-375 million)

Źródło: Relacje Inwestorskie spółki

This hybrid strategy (defensive dividend + active buyback + cost restructuring) positions Altria as a classic “dividend aristocrat” with EPS growth potential, even with further erosion in traditional cigarette volumes.

Forecast for 2026 – Moderate growth concentrated in H2

Altria’s management has presented a conservative forecast for fiscal year 2026, assuming adjusted diluted EPS in the range of $5.56–5.72, which translates into organic growth of 2.5–5.5% compared to the $5.42 achieved in 2025. Key feature of the guidance: growth will be heavily weighted toward the second half of the year (H2-weighted), resulting from the expected increase in cigarette import and export activity in the second half of the year, which partially offsets seasonal trends in the US.

Additional forecast parameters:

- Tax rate: 22.5–23.5% – stable, with a slight downward range thanks to tax structure optimization.

- Capital expenditures (CAPEX): $300–375 million, including key investments in expanding contract manufacturing capacity and developing innovative smoke-free products (on! PLUS and successors).

- Amortization and depreciation: approximately $225 million, reflecting investments in fixed assets.

Strategic assumptions (critical for the reliability of the forecast):

- No return of NJOY ACE to the market in 2026 – e-cigarette product remains off the market following regulatory issues.

- Limited impact of anti-illicit measures on volumes of combustible cigarettes and e-cigarettes – Altria expects continued pressure from the illicit market.

This forecast does not assume accelerated growth in the smokeless segment, but is based on a continuation of the trend of higher cigarette prices (+7% in Q4) and cost discipline from the “Optimize & Accelerate” program. For investors, this means low but predictable EPS growth (~4% on average), supported by a capital return policy.

Main risks and opportunities

Key operational and market risks ⚠️

- Macroeconomic pressure on discretionary income: declining cigarette volumes (-7.9% Q4) due to industry contraction (-6.5%) and growth in illegal e-cigarettes – a trend continuing in 2026.

- Loss of Marlboro market share: 39.8% (-1.5 p.p. y/y) to cheaper discount brands; challenge for premium pricing.

- Competition in nicotine pouches: On! is losing market share (7.7%, -1 p.p.) to ZYN and VELO, despite the growing category (56.9% of the oral market).

- E-vapor regulations and write-offs: $2.2 billion in goodwill losses in FY 2025; lack of NJOY ACE hinders growth, FDA review for on! PLUS 12mg continues.

- Currency and tax: potential FX fluctuations and higher tax rate at the upper end of guidance.

Key opportunities for growth and competitive advantage 🚀

- Higher cigarette prices: +7.3% net Marlboro compensates for volume declines, supporting revenues despite market erosion.

- Growth of nicotine pouches: +10.4 p.p. share in the oral market; on! PLUS with FDA approvals (6/9mg) and new PMTAs for 6 flavors – expansion in key states (FL, NC, TX).

- Strong capital returns: $8 billion returned in 2025 (dividends + buyback); $2 billion buyback program directly accelerates EPS.

- Cost optimization: ≥$600 million in savings by 2029 frees up cash flow for investments and dividends.

- New production capacity: CAPEX for contract manufacturing supports scaling of smoke-free products with low leverage (2.0x).

The company’s shares are down 4% before the market opens and are approaching important support levels that have so far underpinned the medium-term upward trend (100-day EMA). The final behavior of the price in this zone may determine whether the current upward trend will continue or whether it will be broken more permanently. Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.