Economic Calendar – Alphabet’s Earnings in The Spotlight

Wednesday’s session on the financial markets is expected to be relatively mixed, after yesterday’s significant sell-off on Wall Street. On the other hand, futures contracts before the opening of the session in Europe indicate an attempt at a rebound after selling pressure. The DE40 contract is currently up 0.3% and the EU50 is up 0.19%. At the same time, the US100 is up 0.22% and the US500 is up 0.26%. Quarterly results on the Old Continent were presented by UBS, Novartis and Crédit Agricole.

UBS financial results for the fourth quarter of 2025: • Pre-tax profit: USD 1.70 billion (forecast: USD 1.46 billion) • Net profit: USD 1.20 billion (forecast: USD 966.7 million) • Share buyback of USD 3 billion in 2026, further actions planned • Expected further cost savings: USD 2.8 billion in 2026

Crédit Agricole’s results for the fourth quarter: • Revenue: EUR 6.97 billion (forecast: EUR 6.78 billion) • Net income: EUR 1.03 billion (forecast: EUR 1.10 billion) • CIB revenue: EUR 2.15 billion (forecast: EUR 2.14 billion) • Net income from French retail banking: EUR 150 million (-18% y/y) • Operating expenses: EUR 4.10 billion (forecast: EUR 3.90 billion)

Novartis financial results for the fourth quarter: • Revenue: $13.34 billion (forecast: $13.68 billion) • Basic earnings per share: $2.03 (forecast: $2.01) • Dividend for the financial year: CHF 3.70 • Forecast net sales growth in 2026: low single digits

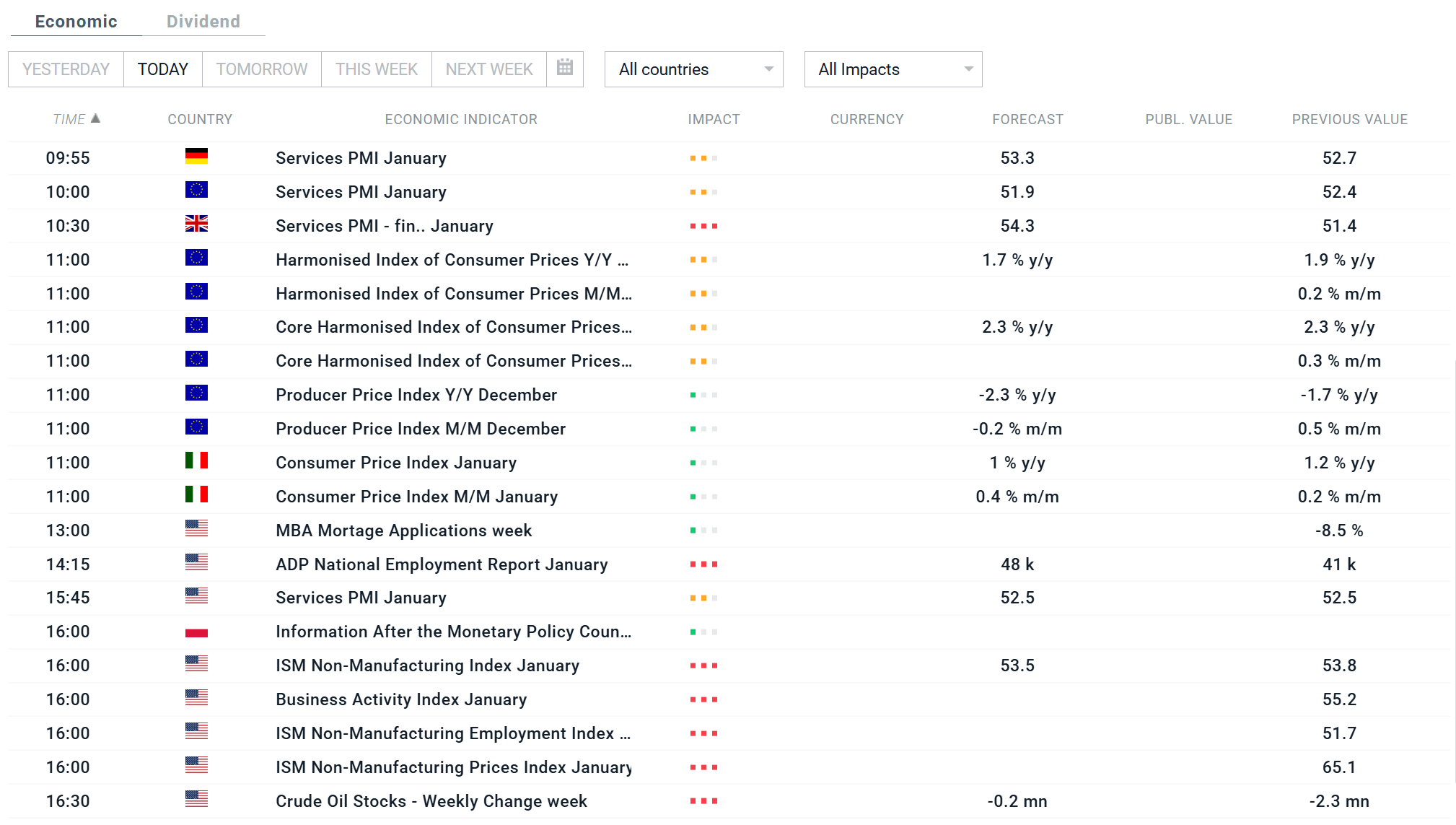

In the near future, it is worth paying attention to the following data: the final PMI index for the services sector (January) from many countries, the preliminary HICP index for the eurozone (January), the preliminary CPI index for Italy (January), the US ADP index (January), the ISM index for the services sector (January), the minutes of the Riksbank meeting (January), the government refinancing announcement (January), ADP in the US (January), ISM Services (January), NBP policy announcement, financial results for Alphabet, Arm, Qualcomm, ELF, Snap, Uber, Eli Lilly, AbbVie, CME and Bunge.

Detailed economic calendar below:

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.