European indices are posting moderate gains, catching up with US peers, who successfully rode Santa Claus Rally over the previous week. Dutch AEX leads the rebound (NED25: +0.5%), followed by French CAC40 (FRA40: +0.2%) and Spanish IBX35 (SPA35: +0.2%). German DAX (DE40) and British FTSE 100 (UK100) are up about 0.15%

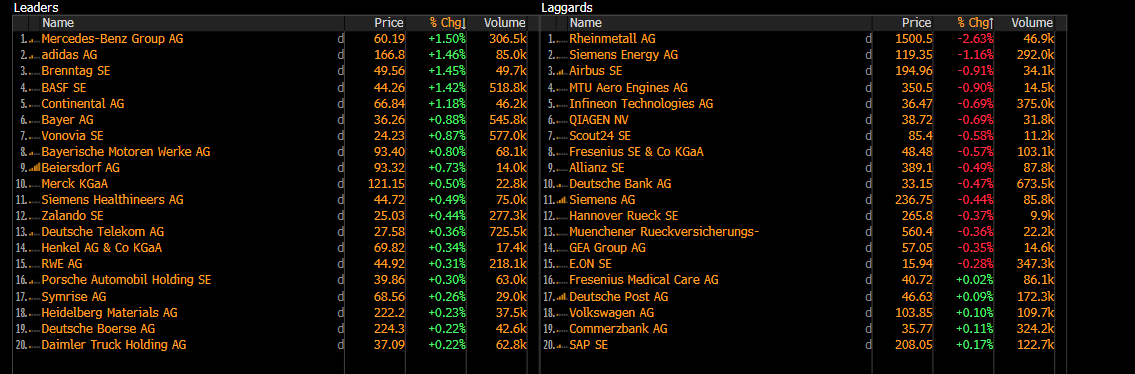

Volatility in DAX-listed stocks today. Source: Bloomberg Finance LP

Defense stocks lead losses in today’s European trading in an aftermath of productive, yet inconclusive talks between US and Ukraine presidents (RHM.DE: -2%, LDO.IT: -3.6%). President Donald Trump said talks with Ukrainian President Volodymyr Zelenskiy made “a lot of progress” toward a peace deal, though key issues remain unresolved and no timeline is set. Zelenskiy said about 90% of the framework is agreed, including security guarantees and military aspects, with disputes over Donbas and the Zaporizhzhia nuclear plant outstanding.

Trump remains in contact with Putin and plans further talks with Ukraine and European leaders in January. The anticipation of another meeting with Russia’s president can exert further downward pressure on the defense stocks, even though markets already got used to “no breakthrough” scenarios after the Alaska summit.

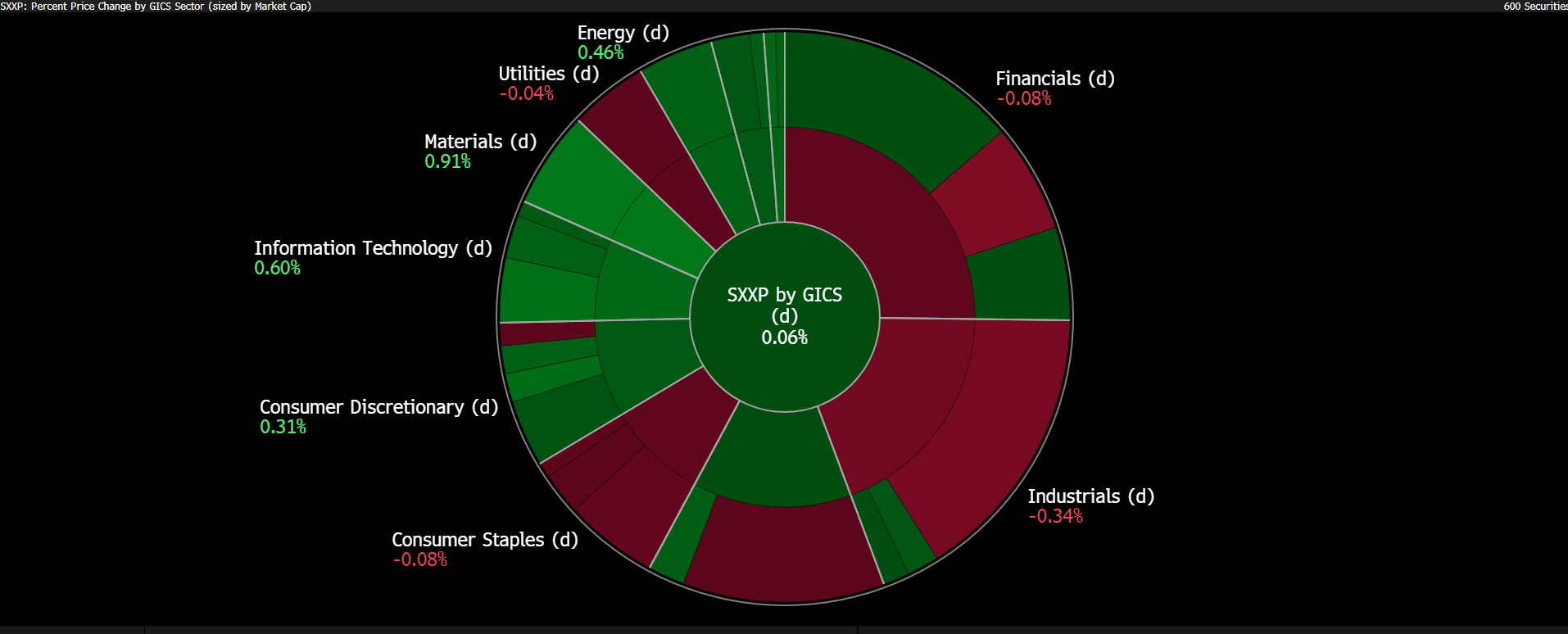

Aside from the defense sector, Consumer Staples and Financials are posting marginal losses, while Materials, IT and Chemicals are driving today’s calm optimism.

Volatility in Stoxx 600 sectors. Source: Bloomberg Finance LP

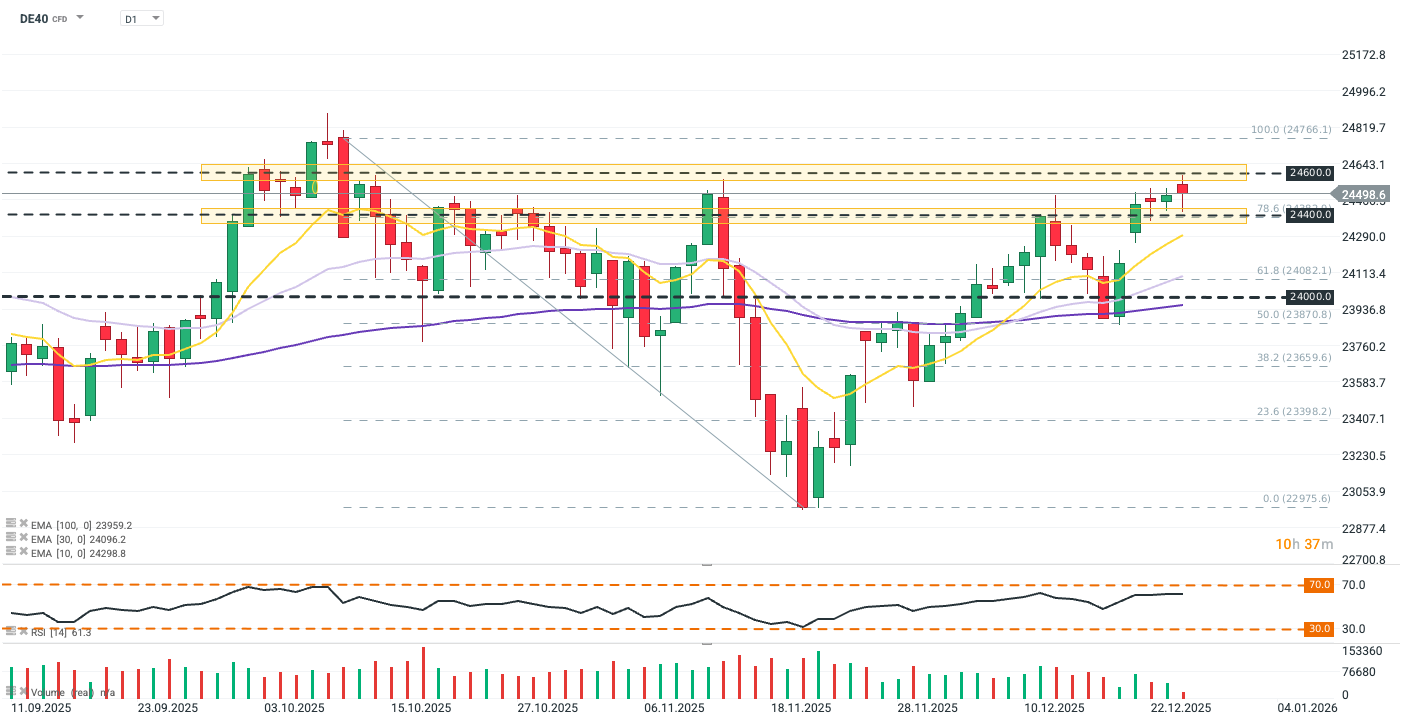

DE40 (D1)

The DE40 contract maintains a strong bullish structure on the daily chart, trading well above its key exponential moving averages (EMA 10, 30, and 100). Currently, the price is testing the upper boundary of a significant zone near 24,484 points, supported by the 78.6% Fibonacci retracement level (24,400 pts).

The immediate target for bulls is a sustained breakout above the resistance area near 24,600 points (yellow zone). With the RSI at 61, healthy momentum suggests further upside potential before reaching overbought conditions. Staying above the 24,400 threshold remains critical for maintaining this trend.

Source: xStation5

Company news:

- International Personal Finance (IPF.UK) is up 5.6% after announcing it will be acquired by US firm BasePoint Capital for £543 million, ending nearly 20 years as a London-listed company. BasePoint will pay 235p per share, a 31% premium. IPF, serving 1.7 million underbanked customers across Europe and Mexico, is expected to benefit from BasePoint’s expertise in consumer finance.

- Mercedes-Benz (MBG.DE) has become the fifth-largest shareholder in Chinese firm Qianli after its tech unit acquired 135.6 million shares from Lifan Holdings, without changing control of the company. The move underscores Mercedes’ push to deepen ties in China. Separately, the automaker gained approval to integrate an AI-powered virtual assistant into vehicles, alongside Tesla and Volvo, signaling easing regulatory pathways for automotive AI services in China. The stock is up 1.4%

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.