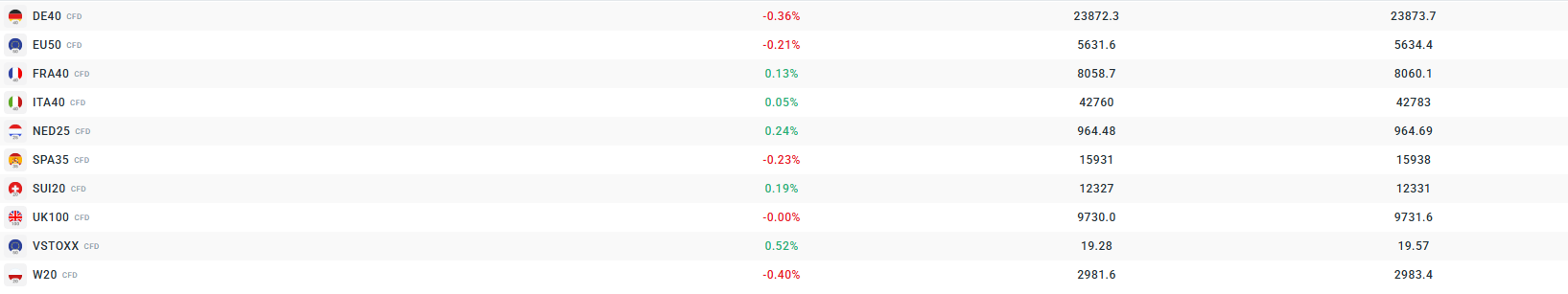

European stocks start Wednesday, November 5, 2025, lower, following a correction in the U.S. market, where technology shares are sharply down. The German DAX index is down around 0.5%, the French CAC 40 falls 0.2%, and the British FTSE 100 about 0.1%. Weakness in the European market continues the trend from the U.S. and Asia, where investors are increasingly concerned about high valuations of technology and AI-related companies.

Additionally, positive macroeconomic signals are arriving from the eurozone. The final composite PMI for the eurozone in October stands at 52.5, exceeding the forecast of 52.2. In the services sector, the eurozone PMI is 53 versus a forecast of 52.6. In Germany, the services PMI rose to 54.6 from 51.5 in September, also above expectations. Despite these economic positives, the equity market remains under pressure, as investors continue to react cautiously to uncertainty in the technology sector.

Global uncertainty and investor concerns about the future of the technology sector are fueled by statements from leaders of major U.S. banks, including Morgan Stanley and Goldman Sachs, who question the sustainability of current high valuations.

Against this backdrop, German industrial orders increased by 1.1% month-on-month in September, after a previous decline of 0.4%, signaling positive momentum in the economy. Oil prices are stabilizing after earlier declines, due to rising U.S. inventories and concerns about weak demand.

Source: xStation

Currently observed volatility in the broader European market.

Source: xStation

In recent weeks, the DE40 index (German DAX) has slowed its rise and entered a correction, falling below the short-term EMA(50) and testing the EMA(100) support. The market has lost some gains from the October peak but remains above the long-term EMA(200), which may indicate stabilization. This situation shows that investors are cautious after rapid gains and are now waiting for new macroeconomic impulses and corporate results.

Source: xStation

Company news:

BMW(BMW.DE) shares rise following third-quarter 2025 results, despite market challenges and a year-on-year profit decline. Investors positively view stable sales in Europe and the U.S. and the growing share of electric vehicles, highlighting the company’s strategic development in electromobility. BMW continues its “Neue Klasse” program, launching new models aimed at strengthening its global position, especially in the premium segment. Despite tougher conditions in China and cost pressures, the company maintains a solid automotive EBIT margin and increasing vehicle deliveries, supporting positive market sentiment.

BMW Q3 2025 financials:

- Pre-tax profit: €2.3 bn (down 9.1% YoY)

- Cumulative profit for the first nine months: €8 bn

- Automotive EBIT margin: 5.2%

- Vehicle deliveries: 588,000 units (up 8.7%)

- Europe: +9.3%

- U.S.: +24.9%

- China: flat YoY

- Automotive segment revenue: €28.5 bn (up 2.4%)

BMW full-year 2025 guidance:

- Pre-tax profit: ~€10 bn (slight YoY decline)

- Automotive EBIT margin: 5–6%

- Automotive net cash flow: >€2.5 bn

Novo Nordisk (NOVOB.DK), the Danish pharmaceutical giant, continues a deep restructuring, announcing around 9,000 job cuts worldwide. The company lowers full-year 2025 profit guidance due to rising competition in the obesity drug segment and restructuring costs, although it recorded a 5% increase in operating profit in the first three quarters. Sales of its popular drug Wegovy are growing, but competition from Eli Lilly and others is affecting prices and growth rates. In Q3, total sales were DKK 75 bn, and operating profit fell about 30% to DKK 23.7 bn, with Wegovy sales at DKK 20.4 bn.

Siemens Healthineers (SHL.DE) forecasts a decline in net profit for fiscal year 2026, mainly due to higher tariffs and unfavorable exchange rates, especially a strong euro against the dollar. Despite these challenges, the company expects revenue growth of 5–6% and plans to increase dividends, supported by solid cash generation and debt reduction. Siemens Healthineers also emphasizes continued investments in medical technology development, adapting its strategy to the changing market environment. Markets reacted cautiously, with shares falling around 7% on the forecast and uncertainty related to tariffs and currency rates.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.