MicroStrategy in Trouble? Shares Down 67% From Highs

MicroStrategy’s preferred shares have lost nearly 7.0% and 13.5% this month as sentiment in the cryptocurrency market deteriorated. As a result, the decline in preferred shares raises questions about the company’s ability to continue financing Bitcoin purchases and covering cash-paid dividend obligations.

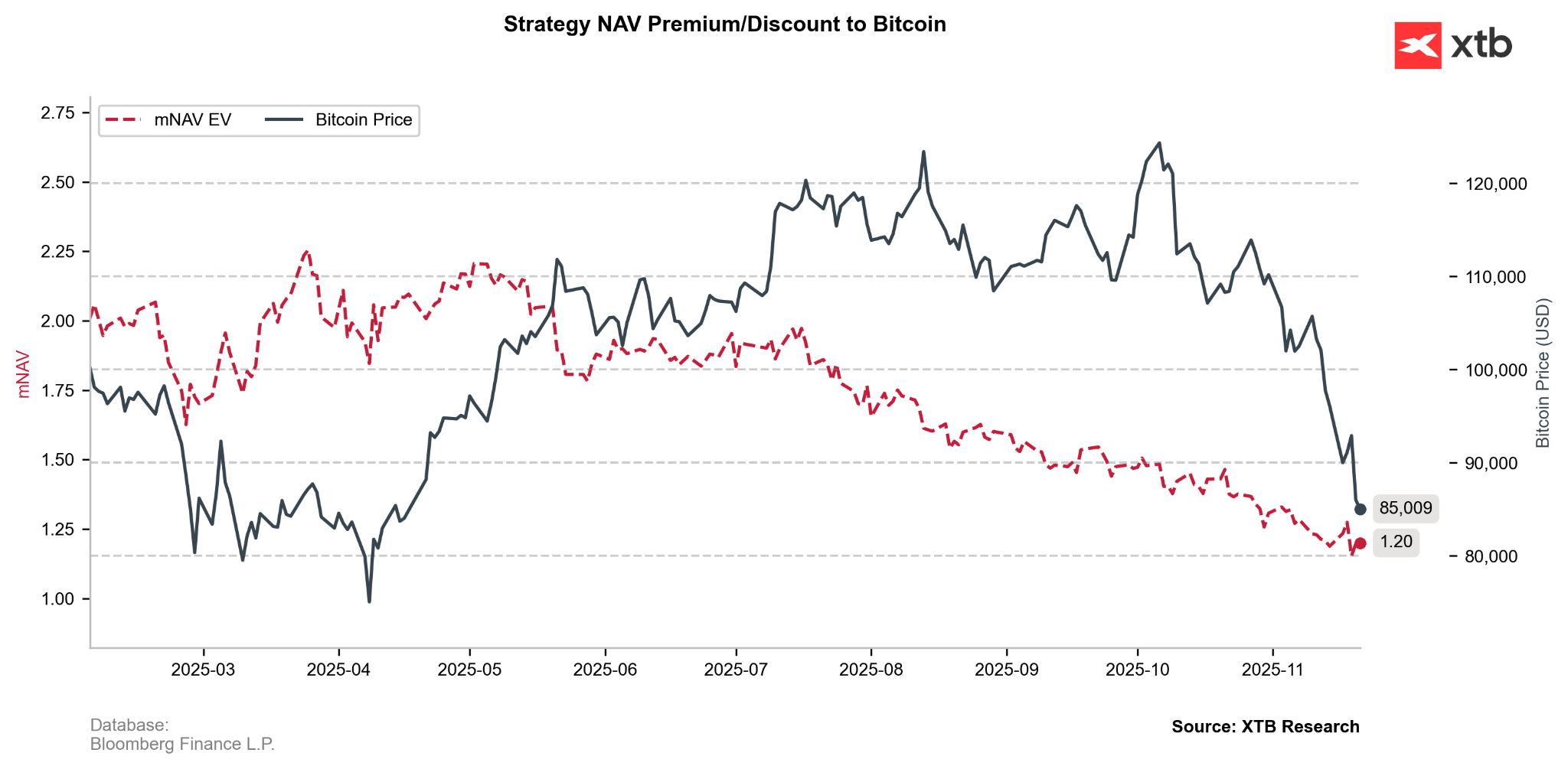

The company’s premium, which historically allowed Strategy (MSTR.US) to raise capital more cheaply than buying Bitcoin directly, has been declining steadily since mid-2025 (mNAV = EV/BTC holding).

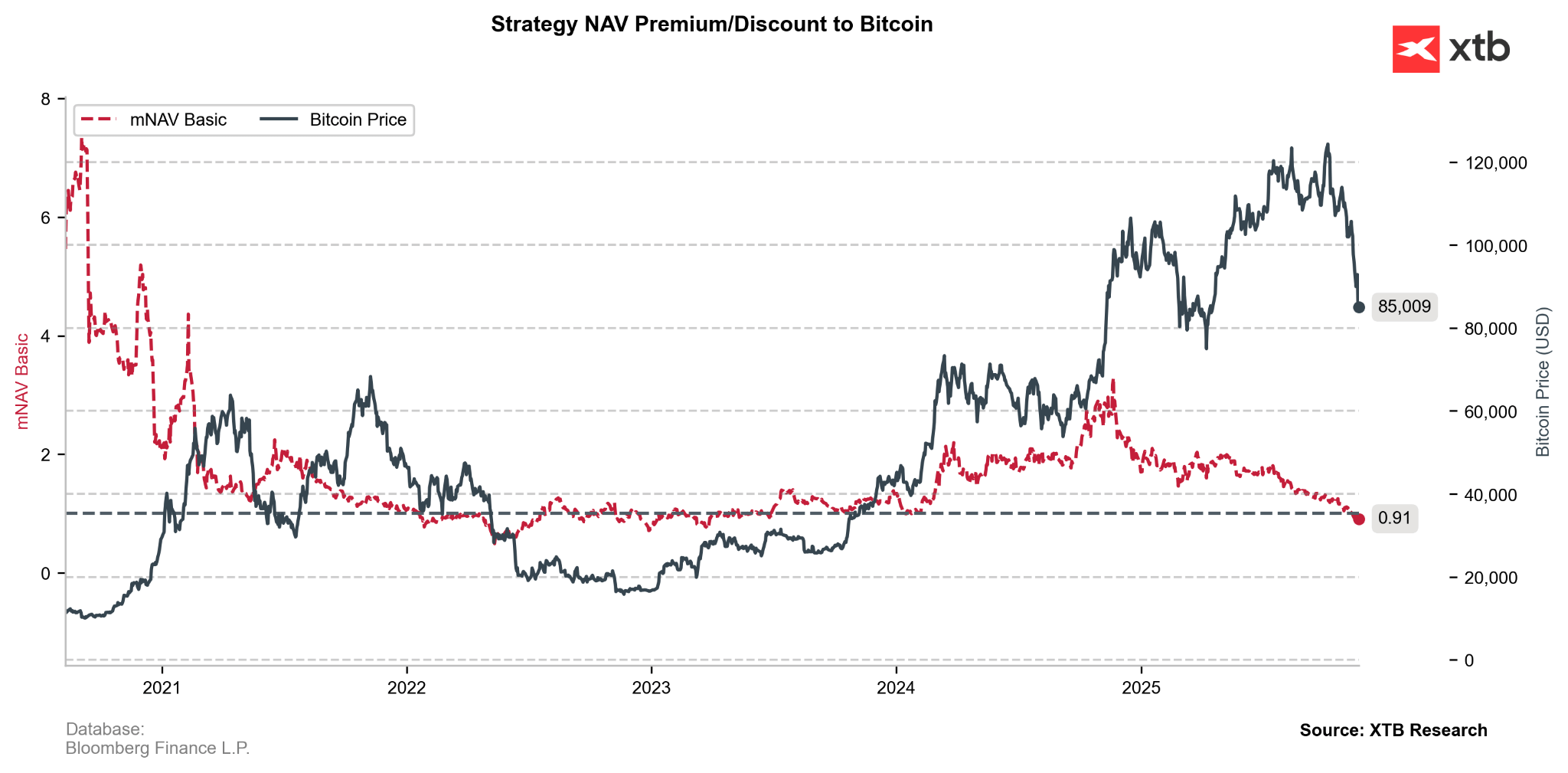

The mNAV Basic ratio (mcap / BTC holding) has fallen below 1, meaning the company’s total market capitalization is now lower than the value of the Bitcoin it holds at current prices. JPMorgan also warned that MicroStrategy could be removed from major MSCI indices, which could trigger outflows of 2.8–8.8 billion USD.

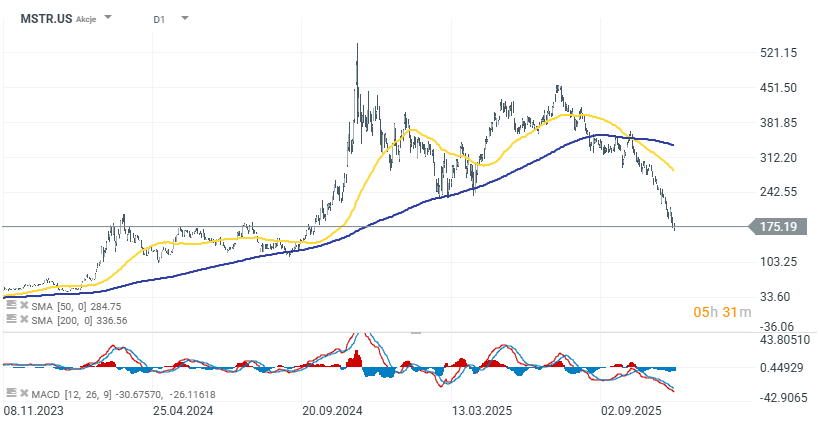

MSTR shares have fallen 10% this week, 55% over the past six months, and 60% year-over-year — much more sharply than Bitcoin itself, which is down 32% from the peak. The stock is trading near 52-week lows amid very high volatility. The company continues to raise capital through new preferred-share issuances, but rising funding costs and the risk of index removal remain key risk factors for investors. In the short term, the most important element appears to be stopping the decline in Bitcoin. Strategy is not facing a liquidity threat, as the nearest debt obligations mature only in 2027 (a small portion) and in the years that follow.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.