S&P 500 Climbs Over 1%

“Davos Trump” sparks best session since November

Investors have reacted with palpable relief to a pivot in rhetoric from Donald Trump, who signalled a move away from military posturing regarding the acquisition of Greenland. Speaking at the World Economic Forum in Davos, the President adopted a uncharacteristically measured tone, notably omitting any mention of retaliatory tariffs against nations that recently deployed armed forces to the territory.

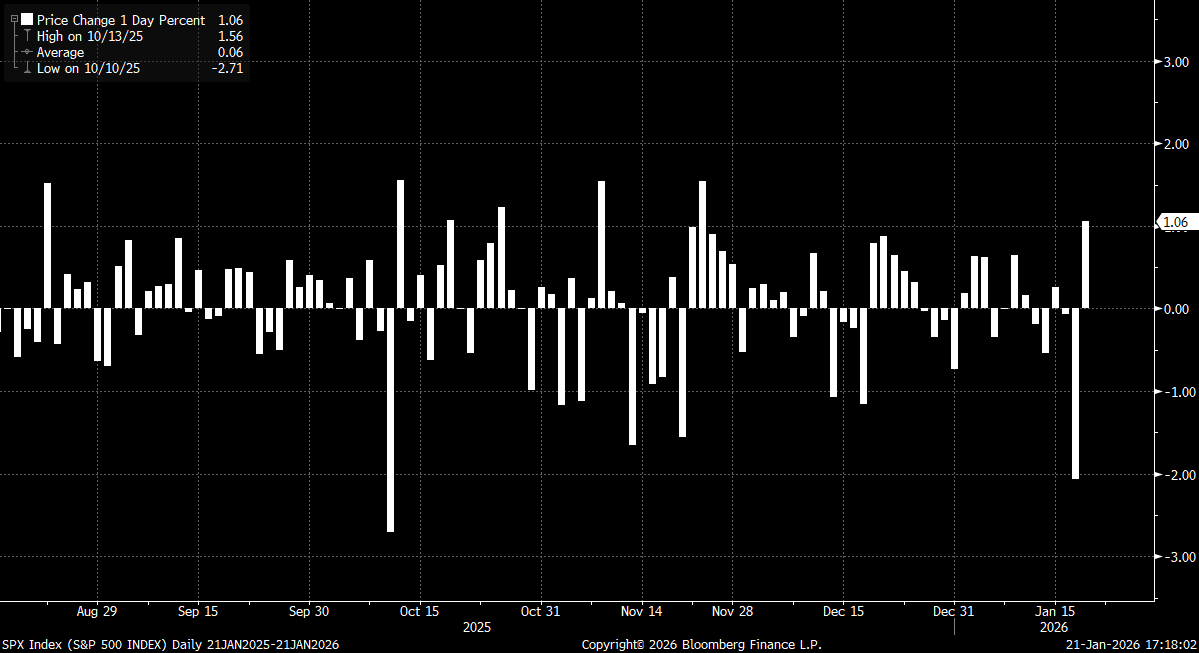

The US500 contract, tracking the S&P 500, gained approximately 1% in early trading. While the move initially mirrored the rally seen on December 19, the momentum quickly accelerated, marking the index’s strongest daily performance since November. Market observers have noted that the current price action bears a striking resemblance to the October “V-shaped” recovery; following a sharp 2% pullback, the index established a local bottom before embarking on a sustained march toward fresh record highs.

S&P 500 daily changes. Source: Bloomberg Finance LP

Wall Street commentators suggest that the decision to de-escalate the Greenland standoff—coupled with the President’s silence on proposed credit card interest rate caps—points toward a “quiet retreat” from some of his more contentious policy proposals.

On a technical basis, the US500 is currently testing the 6,900 handle. A decisive break above the 23.6% Fibonacci retracement of the most recent major impulsive wave would bolster the case for a resumption of the primary bullish trend, keeping the current decline within the bounds of a standard correction.

However, the spectre of protectionism remains. The tariff saga is far from resolved, particularly as markets await a definitive ruling from the Supreme Court on the President’s use of executive powers to bypass Congress on trade levies. While the Court issued three unrelated rulings on Tuesday, its continued silence on the tariff mandate maintains a floor of underlying uncertainty for global investors.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.