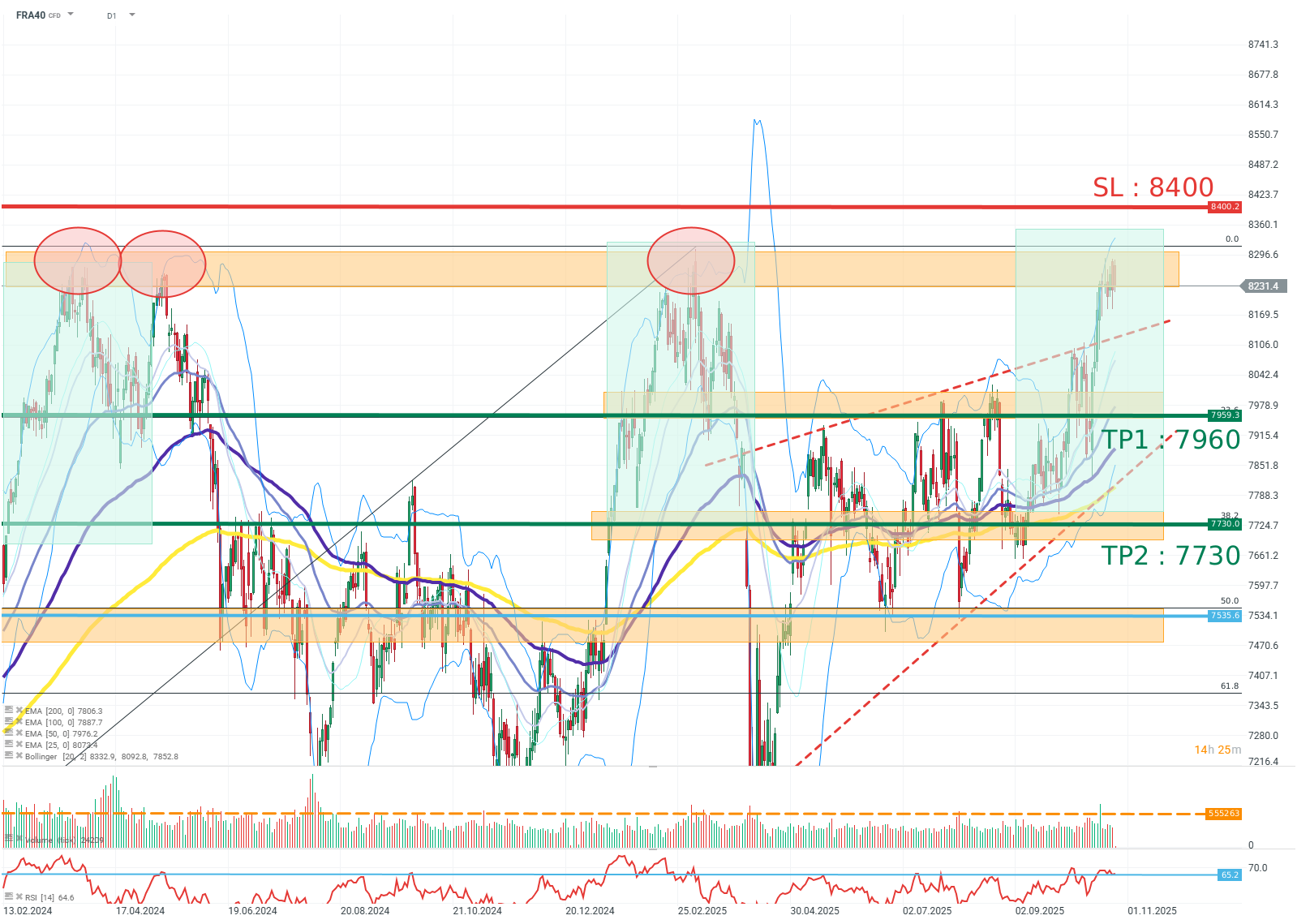

Trade of The Day – CAC40

Facts:

- The rate is testing the all-time high for the 4th time in 2 years.

- The previous 3 attempts to break the level ended in failure.

- The RSI(14) indicator shows a value above 50(65), signaling overbought conditions.

Trade: SHORT position on FRA40 at market price.

Target: TP1 – 7960, TP2 – 7730

Stop: SL1 – 8400

FRA40 (D1)

Source: xStation5

OPINION: On the FRA40 contracts chart, the fourth test and attempt to break the peaks can be observed. According to the accepted practice of technical analysis, a greater number of unsuccessful resistance tests strengthens it, and the fourth test usually ends with a downward correction. Moreover, the recent increase is occurring on relatively low sales volume, signaling an unsustainable rise in valuation. From a technical point of view, the level of FIBO 0, elevated RSI(14) indicator, and the upper limit of the Bollinger band also favor sellers. Fundamentally, the index also does not have many reasons for growth. The recent political crisis in France shows systemic problems of the state and budget. The temporary improvement in the situation was achieved with significant concessions and withdrawal from reforms, which were too conservative considering the financial situation of France. In short, fundamentally, many good things would have to happen in France to justify the valuation, but it is enough for anything to go wrong to bring another correction on the chart. Investor concerns are indicated by, among others, the spreads of French bonds compared to German (increase) and Italian (decrease) bonds.

Methodology and assumptions:

The recommendation is based on technical analysis of the FRA40 chart, particularly the RSI indicator, Fibonacci levels, and Bollinger bands.

Target level: Take profit 1 results from the resistance level at FIBO 23.6, the presence of the EMA50 average, and the average correction range of the last 2 upward waves. Take profit 2 is set slightly below the EMA200 average and at the FIBO 38.2 level.

The defensive stop loss order is set above the last peak at the level of 8400 according to the average fluctuation ranges of the last 2 upward waves.