Trade of The Day – Nasdaq 100

Facts:

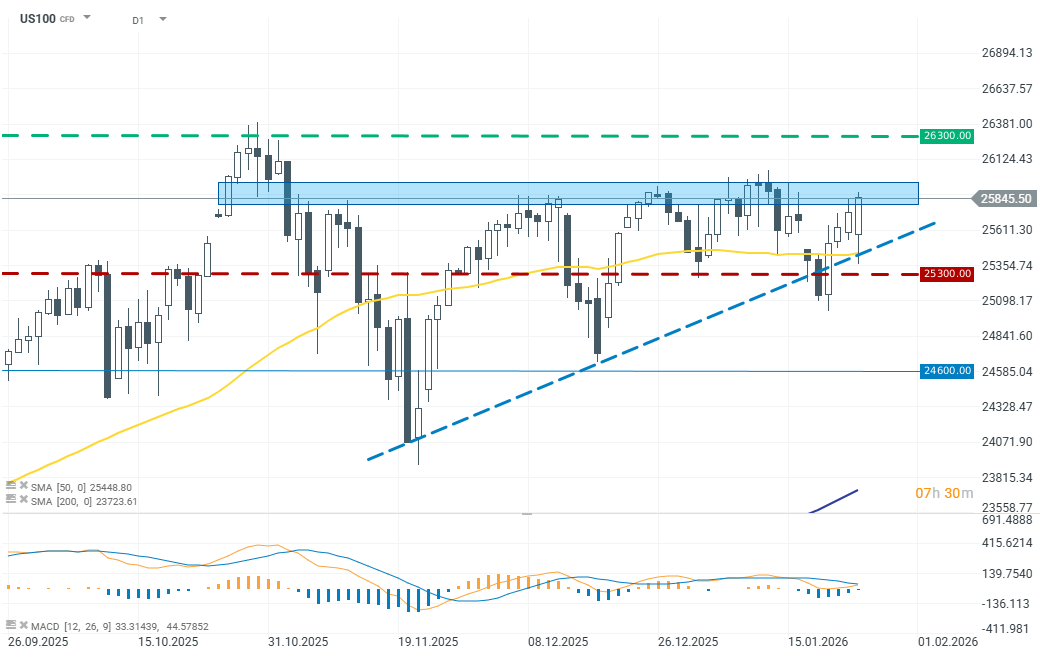

- The US100 is trading just below the upper boundary of an ascending triangle formation;

- The 20-day RSI is holding around the 55 level;

- Major technology companies (AAPL, MSFT, META, TSLA) are set to release earnings in the coming sessions;

- The market expects the FOMC to leave interest rates unchanged.

Recommendation:

Long position on US100 at market price

- TP: 26300

- SL: 25300

Opinion:

The US100 remains technically constructive, with price consolidating just below the resistance zone defined by the ascending triangle formation. Historically, this setup often resolves to the upside when momentum remains positive. The RSI around 55 confirms healthy trend strength without signs of overheating, leaving room for further gains.

From a fundamental perspective, the index is entering a key earnings window led by Apple, Microsoft and Meta — companies closely tied to AI spending, cloud expansion and consumer demand. Early analyst commentary remains constructive, with upward revisions to earnings forecasts supporting a bullish narrative for the US100.

For these reasons, we recommend opening a long position at market price, with a stop-loss order in place to minimize potential downside risk.