Trade of The Day – OIL.WTI

Facts:

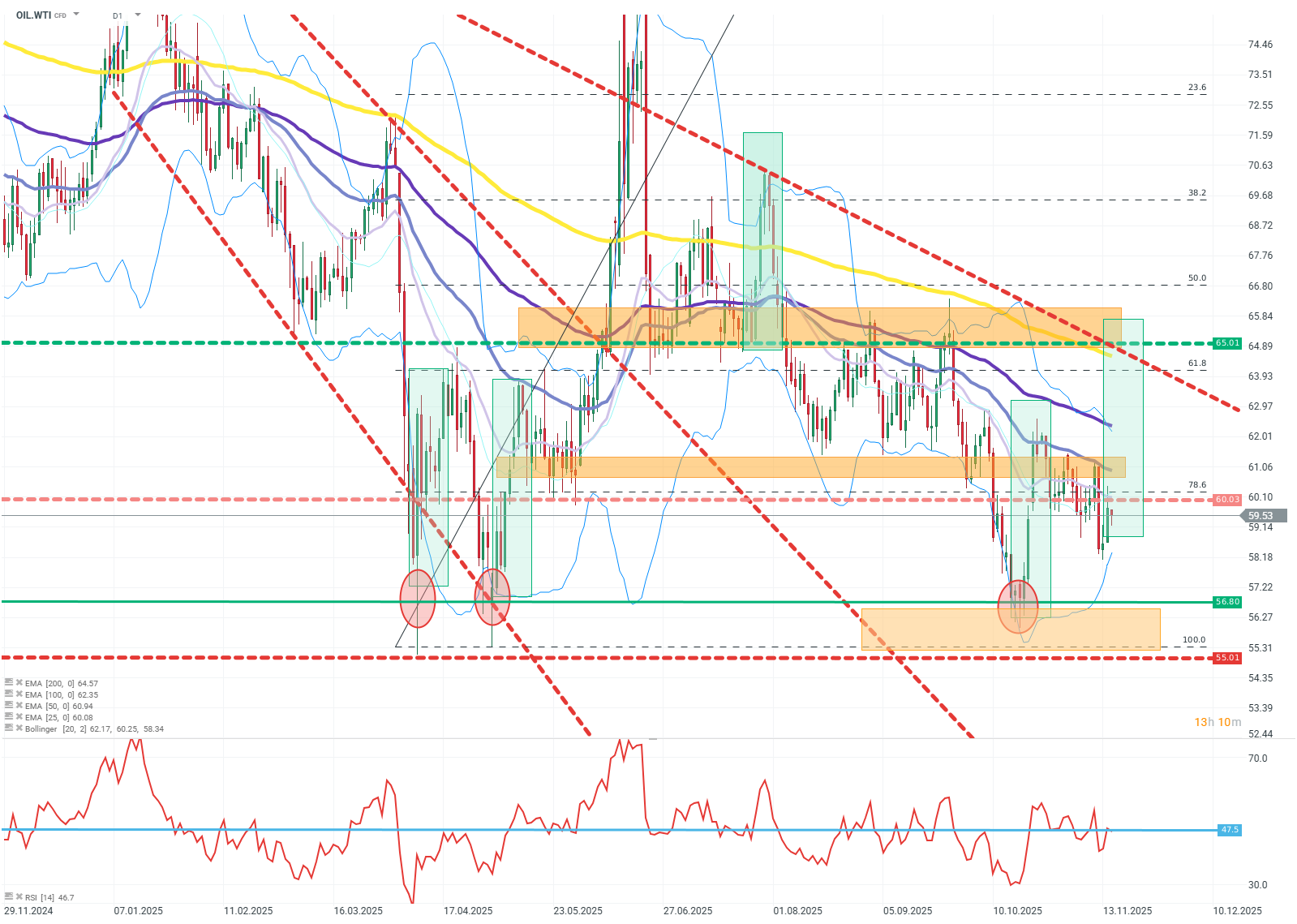

- The previous 3 attempts to overcome the 55-56 level ended in failure.

- The RSI(14) indicator shows a value below 50 (47.5), indicating moderate overbought conditions.

- The price is below the middle Bollinger band.

- The price is within the 78.6 – 100 Fibonacci retracement range of the last upward wave.

Trade: LONG position on OIL.WTI at market price.

- Target: TP – 65

- Stop: SL – 55

OIL.WTI (D1)

Source: xStation5

OPINION: The oil price chart shows three unsuccessful attempts to overcome the 55-56 dollar level. The market clearly does not accept a lower price, and buyers are defending the resistance, waiting for conditions more favorable for growth. This creates a triple bottom formation, the realization of which will result in an upward technical correction.

Methodology and assumptions:

The recommendation is based on technical analysis of the OIL.WTI chart, particularly the RSI indicator, Fibonacci levels, and Bollinger bands.

Target level: Take profit 1 results from the resistance zone formed above the FIBO 61.8 retracement, the presence of the EMA200 average, and the average range of movement of the last 4 upward corrections. The defensive stop loss order is set below the 55.50 dollar level, the breach of which would negate the realization of the technical formation.

Employees of the Analysis Department, as well as other persons involved in the preparation of this report do not have any knowledge about positions of Today Markets (TM) in financial instruments. In addition, Trading Department employees are not taking part in preparation of reports and/or market commentaries.

There is a conflict of interest between TM and the Client resulting from the fact that TM draws up General Recommendations regarding the Financial instruments, which TM also has in its offer. In addition, if as a result of the General recommendation obtained, the Client concludes a transaction in TM, there is a conflict of interest in that TM will be the other party to the transaction entered into by the Client. TM takes the appropriate steps to minimize the impact of this conflict of interest.