USD/CAD Price Forecast: Sees more downside below 1.3800 amid US-EU tensions

- USD/CAD trades sideways around 1.3835 ahead of US President Trump’s speech at WEF in Davos.

- Trump imposes 10% tariffs on EU members against their opposition for US control of Greenland.

- US Treasury Secretary Bessent urges countries and companies not to retaliate against US tariffs.

The USD/CAD pair trades in a tight range around 1.3835 during the late Asian trading session on Wednesday, but is close to its over-a-week low of 1.3815. The Loonie pair consolidates as investors await speech from United States (US) President Donald Trump at the World Economic Forum (WEF) in Davos at 13:00 GMT.

As of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades cautiously near 98.50.

Investors will pay close attention to Trump’s speech to get fresh cues on what more measures Washington can take against European Union (EU) for opposing US control of Greenland.

Till now, US President Trump has imposed 10% tariffs on several EU members and the United Kingdom (UK), leaving room for further increase, until Washington makes “complete and total” purchase of Greenland.

On Tuesday, US Treasury Secretary Scott Bessent urged countries not to retaliate against US tariffs on Greenland crisis, in his interview at the WEF, adding that countries and companies should pause and “let things play out”, Reuters reported.

USD/CAD technical analysis

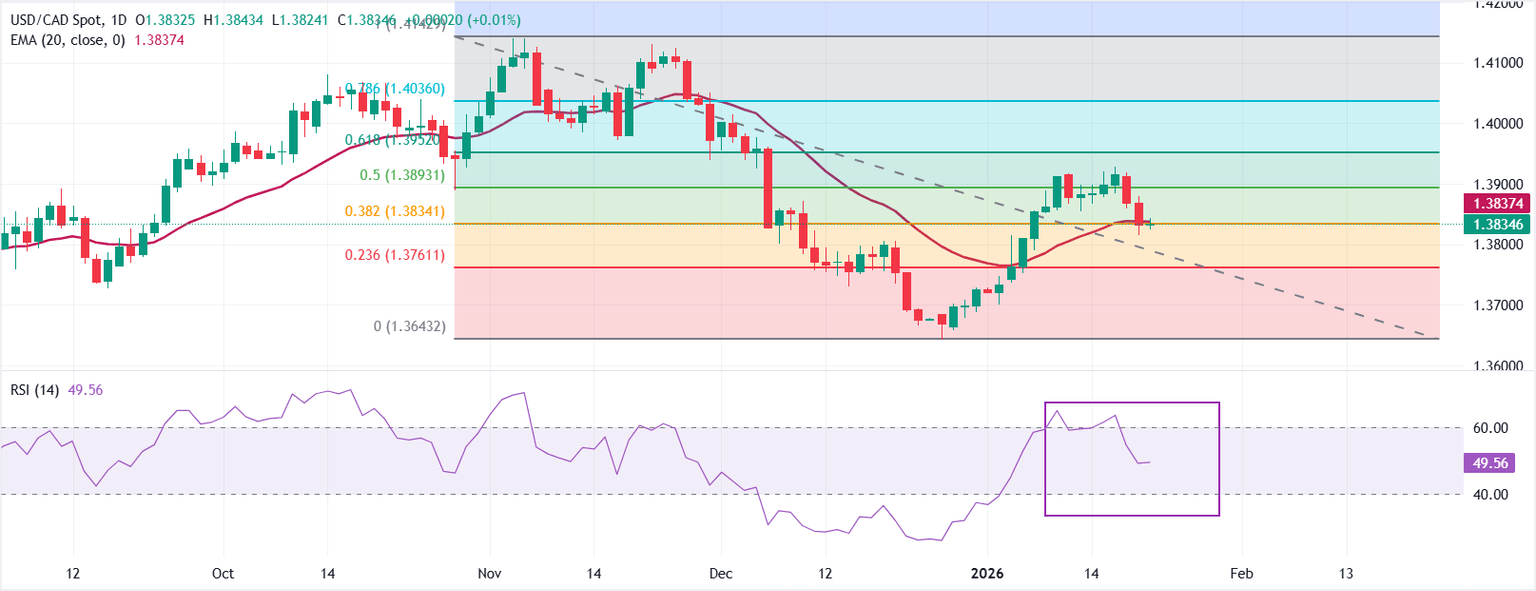

USD/CAD trades flat around 1.3834 as of writing. The 20-Exponential Moving Average (EMA) has flattened near 1.3837 after a steady drift lower and sits marginally above spot, capping rebounds. A close above the 20-day EMA would improve near-term traction, while failure to reclaim it would keep price action choppy.

The 14-day Relative Strength Index (RSI) at 49 (neutral) confirms a balanced momentum profile.

Measured from the 1.4143 high to the 1.3643 low, the 50% Fibonacci retracement at 1.3893 acts as resistance at the current pivot. A push through that barrier could extend gains toward the 61.8% Fibonacci retracement at 1.3952,. On the contrary, the extention of the current decline below 1.3800 could open the room for further downside towards the round-level support of 1.3700.